Insurance customer experience: What lofty expectations mean for insurers

Director of Content

Tags

Share

When it comes to buying insurance, one of the biggest challenges is that most customers take only a cursory look at the policies, but really make their decisions based on how much they’ll have to pay for monthly premiums.

But even though it's long been overlooked as a priority by insurers (and maybe by some consumers as well), the spotlight is slowly turning toward customer experience for the first time in a long time. According to a national survey by KUBRA, almost half (46%) of respondents said that customer experience is a top factor when selecting an insurance provider. And equally importantly, 42% of respondents said that “little or no communication” was their top challenge when interacting with insurers.

On top of that, customers are reaching out to companies on more channels than ever before, from phone calls to emails to live chat and even social media. With all of these challenges, how can insurers maintain an excellent customer experience, without overburdening their teams? That’s what we’ll look at below.

Why is CX important in insurance?

If you asked most people what made them choose one insurance provider over another, they’d likely point to this cost. Many of us, if we’re lucky, never have to go through the second crucial part of the insurance customer experience: the claims process.

Because of this, customer experience (CX) is key to success in the insurance industry. It’s no longer enough to simply offer a product or service—customers now expect a seamless, personalized experience from the very first stage of their journey as they’re browsing your policies and products.

This disconnect between what customers want and need, and what insurance providers are offering, is especially clear when it comes to expectations related to new technologies like artificial intelligence (AI).

According to IBM, only about 16% of insurance providers are using AI virtual assistants, while 38% of consumers are finding value in AI-based customer communication. More importantly, an incredible 60% of insurers surveyeddon’t have a CX strategy.

In other words, there is a significant opportunity for insurance providers to differentiate themselves from competitors—without making any changes to their products—by simply improving their customer experience.

The benefits of a well-designed insurance customer journey

Now, let’s take a closer look at the advantages for insurers that have thoughtful and well-designed customer journeys.

Improved customer retention

There’s no shortage of statistics and evidence showing that when customers have a pleasant and efficient experience with your company, they are more likely to remain loyal customers for the long term.

The converse is true too. According to PwC’s 2020 survey, 41% of respondents said they are “likely or more likely to switch providers due to a lack of digital capabilities.” That number has likely grown, and will continue to grow, as digital channels like mobile apps and social messaging become more popular.

Increased revenue

When your customer-facing teams are able to help customers troubleshoot issues and answer their questions more efficiently, it not only improves the customer experience, but also has a positive impact on your revenue.

In fact, Forrester estimates that in the auto and home insurance industry, if businesses could manage all their customer issues on first contact (more on first contact resolution), that would result in incremental revenue of over $1 billion.

But in order to resolve more customer issues during that very first interaction, your agents have to be well-trained and equipped with the tools (think contact center AI, QA scoring tools, and so on) they need to solve problems efficiently.

Reduced employee turnover

And finally, another key benefit of a good insurance customer journey is reduced employee turnover. This may not be the most urgent goal when it comes to insurance CX, but it should (hopefully) be a natural byproduct of the improvements leading to the two previous benefits.

After all, in order to empower agents and supervisors to help customers more quickly and effectively, they need to be empowered to do this—whether that’s through training or a good insurance agent tech stack. And in general, happier agents are more likely to stick around.

This is already a key consideration for contact center teams, which naturally have a higher-than-average attrition rate, but the insurance industry often has added challenges stemming from the macro-economic environment.

Jeff Rieder, partner at Aon and head of Ward, said that “Claims, in particular, has been a struggle. Companies [had experienced] suppressed claim activity as a result of the pandemic in 2020 and the first part of 2021. Now [that claim activity has picked up again], they’re really having a difficult time in filling those positions, and we’re seeing some negative issues on servicing aspects.”

Long story short: By proactively looking at ways to improve the customer experience in insurance, providers could benefit from not only increased revenue, but also cost savings resulting from more productive and tenured employees.

4 ways insurers can improve the customer experience

Insurers can improve their customer experience in several ways.

1. Use AI-powered customer service technology

From support chatbots to virtual assistants, there are many types of customer service technology that can help insurers reduce response times, answer customers’ questions more quickly, and provide better customer service at scale.

Dialpad Ai Contact Center, for instance, has a conversational AI feature that automatically searches all connected sources of information (even unstructured sources like PDFs and past customer conversations) to find answers to customers’ questions instantly:

Not only does this deflect more calls away from agents, it also helps customers self-service using AI outside of business hours. (Other non-AI self-service options that many companies are familiar with? IVRs (Interactive Voice Response menus) on the phone and online knowledge bases.

👉 Further reading:

Learn more about examples of AI in insurance.

2. Provide omnichannel communications

Not every customer wants to make a phone call to find out details about their policy. Nor does that mean that you don’t need to provide phone support anymore either. The key is to understand which channels your customers use (or want to use) to reach your team, whether you can realistically support them, and how you can get as close to those expectations as possible.

The fact is that customer journeys change. Before COVID-19, for example, only 28% of consumers in the EU preferred using digital channels to contact their insurance providers. That number went up to 43% during the height of the pandemic—and likely has increased even more since then.

Insurers whose customers are also using a variety of different channels to contact support should consider an omnichannel contact center or some type of customer experience platform that let their agents provide omnichannel customer service.

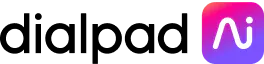

With Dialpad, for instance, agents can communicate with teammates and also customers via phone calls, video calls, SMS/MMS messaging, live chat, and other digital channels like WhatsApp:

This way, they can see the full history and get all the contextual information they need to resolve issues, even if it’s their first time interacting with a particular customer.

3. Improve employee training and coaching

Agents and supervisors are also key to providing a better CX in insurance.

Whether your agents are new hires or tenured experts, regulations and products are constantly evolving (like Medicare call recording regulations), and they need to be up to date on these changes.

Beyond just updating training materials, it’s also important to consider the on-call experience—how can you empower employees while they’re talking to customers?

There are AI call center solutions that are designed to help with this by automatically providing call pops or real-time assists directly onto agents’ screens, as challenging questions come up.

Dialpad’s Ai Agent Assist, for example, does exactly this:

This way, supervisors and managers can rest easy knowing their agents can handle even challenging questions about policies and coverage—without having to personally coach every single call.

That’s not to say insurance providers should just throw their customer support agents into the deep end—AI can also make it easier for managers and supervisors to provide more effective coaching and real-time help when it is needed.

For example, Dialpad Ai can also do live sentiment analysis, which means supervisors can easily see if a call is going poorly, open up the real-time transcript to get more context, and jump in to help the agent if needed:

4. Understand your KPIs (Key Performance Indicators)

When it comes to customer experience analytics, every insurance provider will monitor a unique set of metrics that are important to its business leaders.

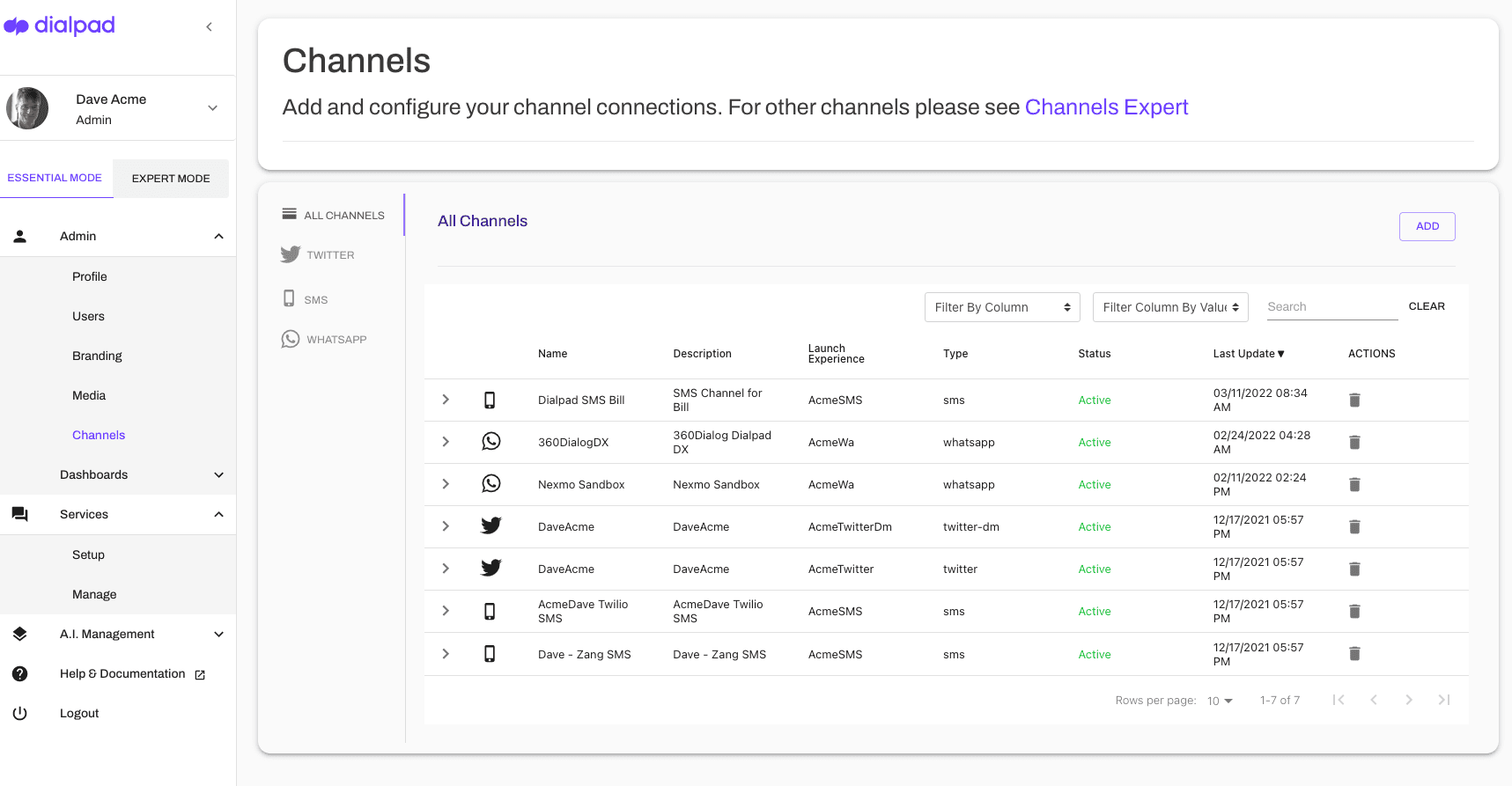

In general though, most companies will track commonly used KPIs like CSAT (customer satisfaction) and NPS (Net Promoter Score) by emailing or texting surveys to customers to fill out. While this has traditionally been the most popular way to gather customer intelligence, there is one big obstacle: not a lot of people actually fill out these surveys.

In fact (depending on the industry and specific business of course), we've found that on average only about 5% of customers actually fill out customer satisfaction surveys. On a related note, usually only the angriest—and happiest—customers actually bother responding, which means your CSAT answers are likely to be very skewed and not representative of how your customers feel overall.

Dialpad's industry-first Ai CSAT feature is designed to solve exactly that, by inferring CSAT scores for 100% of your customer calls. The result? A much more representative sample size for CSAT scores, and a more accurate understanding of how satisfied your customers really are:

5. Streamline key processes for customers

Many insurance companies have complex policies that require a lot of paperwork and manual processing when it comes to filing claims or making changes to policies. Up until recently this has been, for the most part, unavoidable.

But today, with automations and technology, insurers can streamline processes and make them easier for customers by removing unnecessary steps or improving existing ones with new tools like eSignatures or automated document retrieval systems.

Lemonade, for instance, has made a name for itself as an insurance provider thanks to its user-friendly online setup, which makes the insurance process a lot less intimidating for the average consumer:

Want to provide a better insurance customer experience?

Whether you need to support your customers on a wider variety of communication channels or want to reduce the burden on your agents and supervisors, there are many ways to improve your CX (that will also help you increase revenue, customer retention, and other key metrics).

If you’re interested in an AI-powered communications solution that lets your team handle all your customer conversations, uncover more customer insights, and provide better coaching in real time, check out Dialpad Ai Contact Center!

See how insurance companies are providing a better CX

Book a personal walkthrough of Dialpad Ai Contact Center, or take a self-guided interactive tour of the app first!