Ai in insurance

How is Ai being used by insurance companies? From improving customer experiences to fraud detection, there are many interesting use cases. Learn more below, or check out a demo of Dialpad's Ai-powered customer engagement platform to see how some of today's top insurance companies are providing an excellent customer experience with distributed teams!

The deployment of Ai in insurance is revolutionising the industry. From redefining what’s possible in customer service to vastly upgrading fraud detection, many elements of insurance are benefitting from the evolution of Ai.

This guide takes a look at the use of Ai solutions and how it has changed the way the insurance sector operates.

It covers a range of applications that give real-life examples of how insurance companies are making the most of this cutting-edge tech to drive profitability and productivity. You’ll also find a few pointers about trends to watch out for going forward.

What is Ai in insurance?

Artificial intelligence is making itself felt across multiple industries, from manufacturing to game design. In the world of insurance, the practical implementation of Ai is already having a big impact.

Challenges such as detecting fraudulent claims or streamlining policy development are becoming much easier to handle thanks to Ai’s broad-based functionality.

The business model of insurance companies has always relied on large data sets. From the earliest times, the concept of pooling risk so that those who are unlucky enough to suffer misfortune can benefit from communal support has been common. But to make a viable business out of it, you need a huge volume of data—and a way to efficiently process that information.

Luckily, Ai platforms are excellent at processing data. In fact, you could say that Ai and big insurance data sets are a match made in digital heaven.

Benefits of implementing Ai in the insurance industry

Better customer experience

One of the most immediately visible benefits of Ai in the insurance industry is its impact on the customer experience.

Customers have come to expect seamless service. They want to be able to contact you however suits them best and be confident that whoever they’re talking to can answer their policy or claims questions accurately and quickly.

Ai can make it easier for support staff to glean conversation intelligence across voice, digital, and social channels from a single dashboard.

With this kind of technology, you can do more than just get real-time transcriptions of conversations. Ai can analyze that information in real-time and uncover valuable insights.

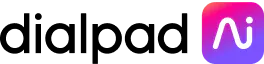

For instance, Dialpad Ai can track keyword topics. You can use the Custom Moment feature to monitor how often particular keywords are mentioned during customer calls:

For the more challenging elements of customer conversations, or if you simply want to ensure consistency in messaging, supervisors can use the Ai Live Coach feature. These are essentially real-time assist cards that pop up with tips for how to deal with common or difficult questions and appear automatically on agents’ screens when Dialpad Ai detects that relevant keywords are spoken on a call.

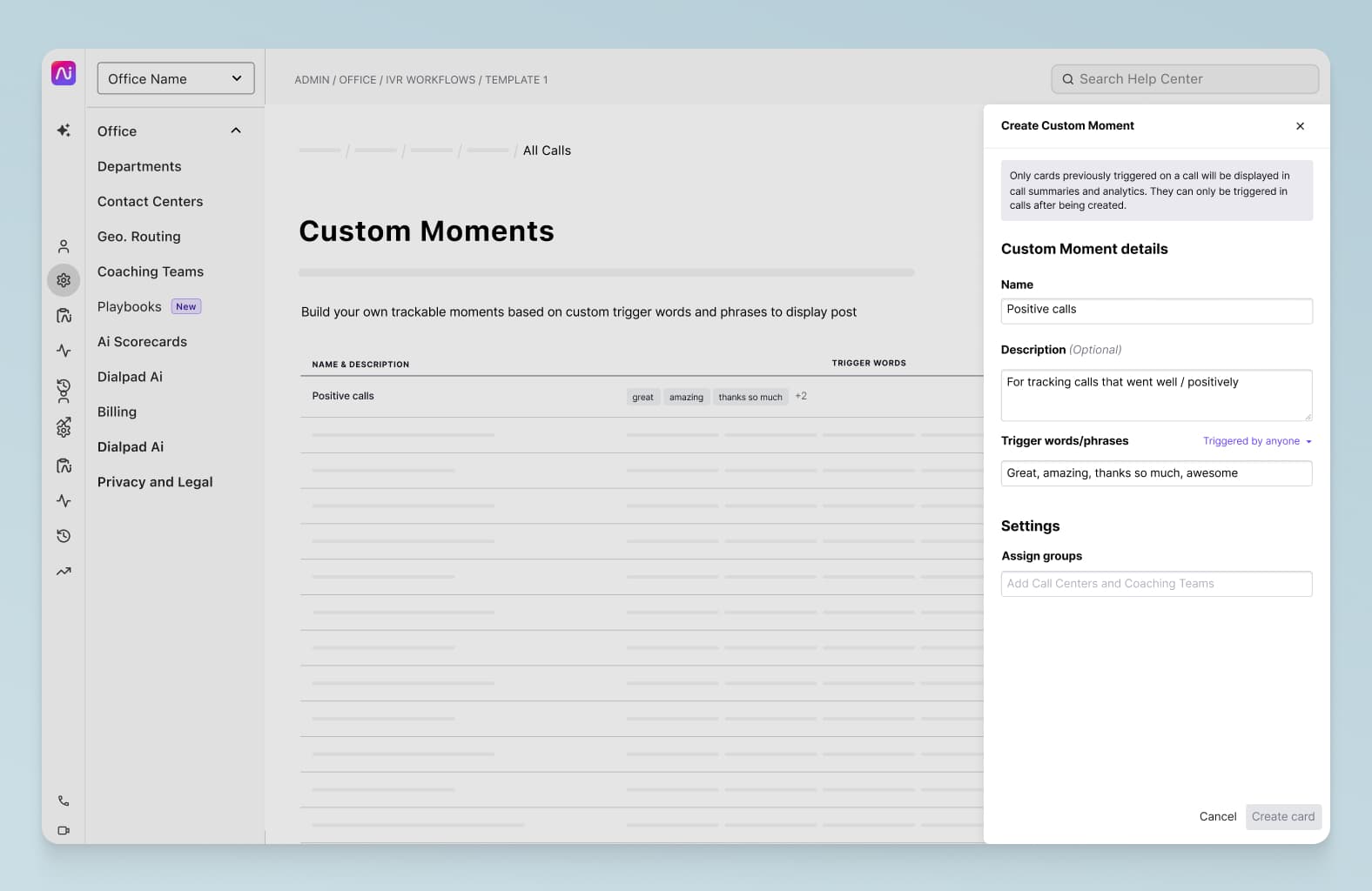

For example, you could set up Ai Live Coach to offer suggestions on how to handle queries about auto insurance claims to activate whenever “accident” or “collision” are mentioned:

Fraud detection

Fraud has long been the bane of every insurance company’s existence. The history of the industry is packed with examples of new technology being used first to get ahead of the fraud arms race, and it’s no different with Ai.

The big advantage Ai tools have here is their capacity to spot patterns in enormous data sets. That makes them very good at finding dubious claims and rooting them out. Even better, this saves countless hours of manual effort to achieve the same result, freeing up staff to concentrate on more productive tasks.

Faster claims management

One common source of client dissatisfaction over the years has been how slow the claims process can be. So, a major focus of many insurance companies is on finding ways to streamline it.

The expanding use of Ai in insurance is breaking new ground in achieving this goal. Because of its ability to process large amounts of data quickly, it can significantly reduce the time taken for claims to pay out, without any loss of accuracy.

Better data processing

Ai’s capacity for efficient data processing can have a huge impact across multiple insurance industry operations.

As a result, companies can target customers much more precisely, developing products tailored to what customers are asking for. (Have you noticed that insurance providers are starting to provide pet insurance now alongside the usual auto and home insurance products?)

Ai use cases in insurance: How are insurance firms already leveraging artificial intelligence?

Automated underwriting

One of the most quickly adopted applications of Ai in the insurance industry has been the automation of the underwriting process.

Since companies have access to large data sets of customer and risk information, they’re well placed to benefit from Ai’s efficiency in data processing. More and more firms are moving away from manual underwriting and embracing generative Ai instead.

Ai and machine learning systems provide actionable insights that emerge from risk predictions. Data sources, too, vary. As well as the company’s own historic customer data, these platforms can use third-party and open-source data such as government statistics. Overall, it makes for less costly and much more efficient underwriting.

Remote risk assessments

Another Ai in insurance use case that’s currently enjoying a surge in popularity is remote risk assessment. It’s not applicable in every case, of course, but modern Ai-based visual detection has reached a standard where some companies consider it reliable enough to use for commercial purposes.

Building insurance is a good example. Using information such as open-source geospatial imagery and government flood map data, companies can get a better idea of the risks involved in insuring certain properties.

Similarly, there is a growing number of Ai-powered tools that provide accurate, touchless damage inspections to inform car insurance claims following an accident.

Customer service

The use of Ai in customer communications in the insurance industry is already fairly well established. And no wonder, as it’s having a transformative effect.

For instance, it’s now fairly common for companies to take advantage of chatbots and conversational Ai to deal with customer queries more efficiently.

With Dialpad’s customer intelligence platform, for example, many customer queries don’t need to make it as far as human customer support staff—they’re solved by Ai, with no need for human intervention. This cuts down on workload for the hard-working support team, while keeping customers happy.

In the event that the customer does need to escalate the call, it happens in a matter of moments, and the support team member they speak to will already have all the information they need to resolve the issue.

There’s more to Dialpad Ai, though. It can provide context-rich information that enables support teams to deliver truly personalised service. It can even predict the customer satisfaction score for a conversation automatically, with no need for customers to fill in CSAT surveys.

Personalisation

Insurance companies are also seeking to increase their profitability by fine-tuning personalisation when issuing policies.

For instance, Ai use cases in health insurance go further than simply providing individualised pricing that depends on risk factors. In many cases, Ai can help provide faster and more accurate diagnoses as well.

The use of conversational Ai in insurance applications also encompasses chatbots that act like a frontline triage service or wellness coach, directing users to potential treatment options or different ways to look after their health (as well as providing a source of data for companies looking to personalise policies).

It’s fair to say that the use of Ai in health insurance settings has only just begun—there is so much potential for further exciting developments in the future.

Ai trends set to impact the future of the insurance industry

Increase in self-service options

There’s an increasing appetite for self-service across a whole range of industries. The digital transformation experts Macro 4 found that 60% of utilities customers in the UK would prefer never to phone customer services at all if there were sufficient online resources for them to sort out their own issues.

Putting the customer in control is a key aspiration of many businesses. It makes sense—offering self-service options increases customer engagement and reduces the burden on employees. But it hasn’t always been obvious how this could be done in the insurance industry.

The Ai-powered chatbot is a great example of how this is already being put into practice. Because it can draw data from a wide range of sources, it delivers reliable results and eliminates the need for clients to wait for support staff to pick up their call.

In the future, it’s likely that there will be even more of a focus on customers being able to build their own insurance policies.

Ai tools will be able to source relevant data from elsewhere, cutting down on the amount of information the customer needs to supply themselves. The result:Taking out an insurance policy will be much faster and less fraught with frustration.

More personalised insurance policies

One of the pain points customers experience when taking out an insurance policy comes if they have highly specialised needs.

While it’s generally pretty straightforward to buy a travel insurance policy for a family trip to Paris, say, complications set in fast if you happen to be an extreme sports fan looking to paraglide over the Arc de Triomphe.

With Ai-powered risk assessment, crafting policies to suit unusual needs becomes much easier. It’s likely that we’ll see more and more examples of insurance companies offering Ai-recommended specialised products that reduce the manual work required.

Even for less extreme examples, Ai’s ability to carry out fast and accurate risk assessments will mean companies can tailor policies more precisely to individual circumstances.

Better business integration

Apart from chatbots and risk assessment, there are plenty of sales Ai use cases in insurance, not least of which is the potential for much more integrated workflows across the company as a whole.

Because Ai tools can process and analyse data in real time, they’re very effective at tasks like forecasting sales cycles (for example, a travel insurance company might do a sales campaign before the busy holiday season) or scheduling calls with prospective customers who are most likely to convert.

This can help streamline your operations and empower your teams to collaborate more effectively, giving overall productivity a shot in the arm.

Ai in insurance: Helping you improve customer experience, save time & more

With Ai, insurance companies can deliver more personalised products and customer experiences.

Dialpad’s Ai-powered customer engagement platform can boost efficiency in everyday processes and empower your customer support and sales teams with data instantly at their finger tips, leading to the kind of time and cost savings that significantly impact your bottom line.

See how insurance companies are using Dialpad Ai

Book a demo with our team, or take a self-guided interactive tour of the app on your own first!