Tags

Share

Understanding how customers perceive your products and services is essential—especially if you want to improve your offerings and deliver experiences that turn strangers into loyal brand advocates.

A customer survey gives you first-hand insights to achieve these goals. The likelihood of obtaining meaningful answers, though, shrinks as more businesses leverage these tools and users are bombarded with questions after every transaction.

So, what strategies can you adopt to avoid survey fatigue? And what tools can you use to optimise the customer experience (CX) and obtain truly useful answers?

But first, let’s look at what customer surveys are, exactly.

What is a customer survey?

Customer surveys are questionnaires organisations send to their customers to track satisfaction, gather data for market studies, and measure evolving expectations. They provide answers to important questions you might have about your business—such as why do some customers leave while others stay?

Whether online, on the phone, or via snail mail, a customer survey is one of the best ways to get unbiased feedback directly from consumers—and it can cost next to nothing. Usually, it’s best delivered when an experience with your brand is fresh in a person’s mind, such as immediately after a customer support phone call.

The essential part is choosing a channel and method that makes it easy for customers to answer your questions:

This is critical. One of the biggest challenges of running customer surveys is the fact that most customers don’t bother answering them. Under the right circumstances, customers are more than happy to share their thoughts—these moments are unfortunately just few and far between.

Benefits of customer surveys

There are many advantages of having customer intelligence and feedback when you’re making important business decisions.

Here are just a few of them:

It makes it easier to pinpoint issues with the customer experience

Even the most well-planned customer journeys can have bottlenecks or gaps. While many businesses may try to infer what’s going wrong with the experience or why customers are dissatisfied, this is often just guesswork.

Running a customer survey will give you more accurate and specific information about how consumers interact with your brand and what they’re unhappy with.

It helps supervisors gauge the performance of teams and agents more effectively

Support teams today are key differentiators for businesses across all industries.

But how do you know how your agents are performing, which agents are going above and beyond, and which areas need improvement?

You guessed it—surveys.

Customer feedback enables you to measure the effectiveness of every agent on your support team. It can also be an important factor in the evaluation of an individual team member’s performance and productivity over time.

Once again, this information is a great opportunity to improve both agent and team performance. This feedback provides important contextual information that you can use in conjunction with quantitative performance metrics.

For example, if an agent’s average handle time is higher than others on the team, but you discover from customer surveys that customers absolutely love how detailed and empathetic that agent is, you might approach that coaching or performance conversation differently (compared if the agent was just taking a long time to resolve issues).

It can highlight customer trends

Customer surveys are also an important supplementary tool that you can use alongside customer behaviour analytics to tailor your services and products more effectively.

Many businesses leverage this combination of data to build a structured Voice of the Customer (VoC) programme and gain a deep understanding of their consumers. This strategy allows them to identify pain points, proactively solve problems, and sometimes even address potential brand crises before they happen.

It provides insights into ways to build customer loyalty and revenue

Once you get inside the mind of your customers, you can learn what they really want from your brand and what makes them tick.

This information is valuable when building upsell and cross-sell strategies, improving customer support training, and much more.

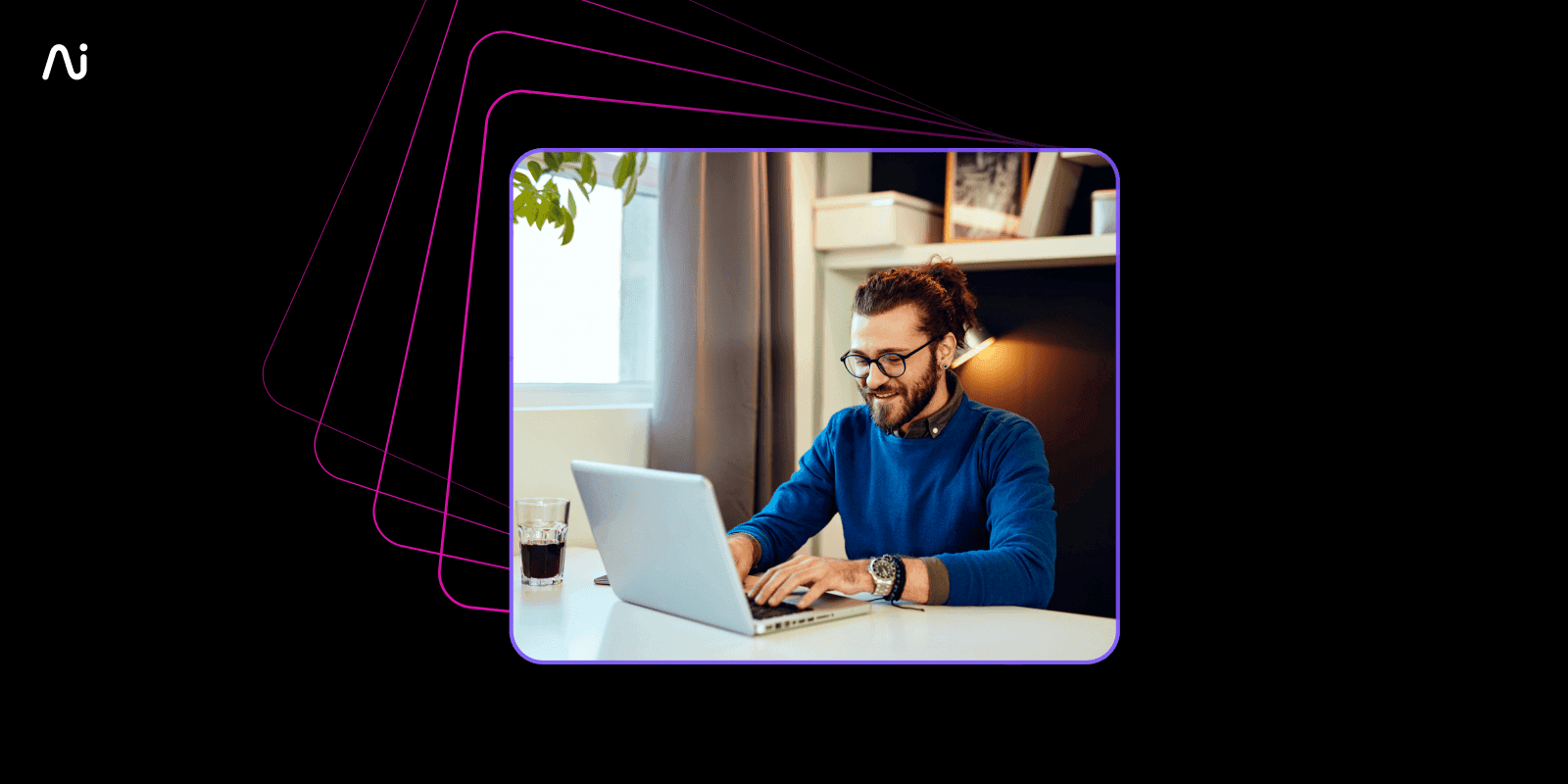

For example, some Ai-powered contact centre platforms such as Dialpad Support have conversation intelligence features that can highlight keyword phrases in calls. For example, you could use Dialpad Ai to analyse your customer success team’s calls to see if there are recurring topics or keywords that tend to pop up in successful upsell or cross-sell conversations. Just create a “Custom Moment” for each keyword you want to track and Dialpad Ai will do the rest:

Different types of customer surveys and when to use them

Not all customer survey types measure the same thing. Each survey targets a specific goal, and is usually best delivered at a particular stage of the consumer journey.

To optimise your questionnaire results, you should first become acquainted with all these options, and understand when’s the right moment to use one type over another.

From customer satisfaction score (CSAT) to Net Promoter Score (NPS) and channel-specific surveys, here are a few things to keep in mind:

CSAT surveys

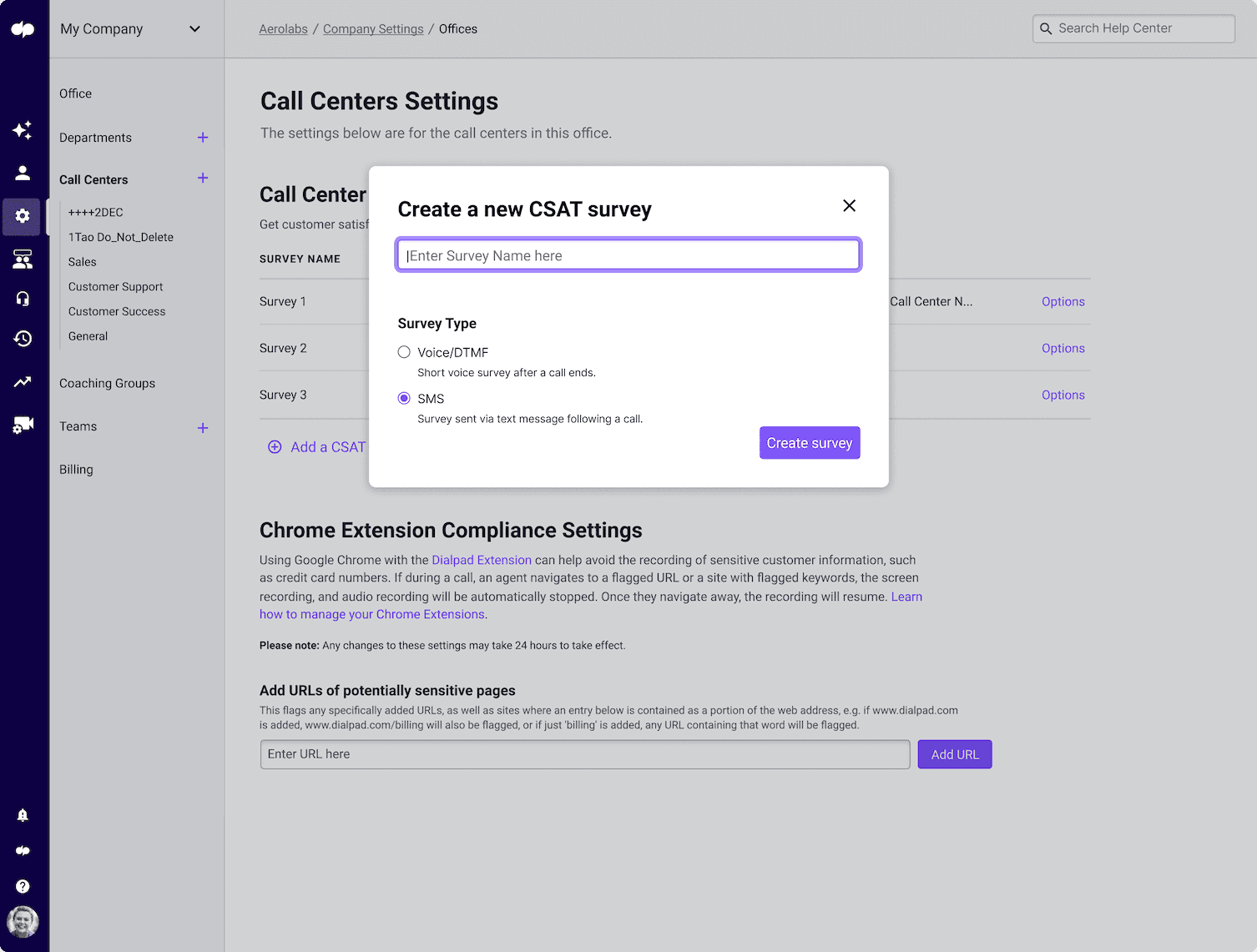

CSAT surveys generally measure how happy customers are with a specific interaction with your brand. Because of this, they’re typically sent immediately after someone interacts with your business, either after a purchase or contacting your support team.

This survey gives you a clear view of what’s working throughout all the stages of your customer journey and whether there are specific types of conversations that require more agent coaching.

For example, is your e-commerce website affected by friction in the check-out experience? Are support agents responsive, empathetic, and knowledgeable when troubleshooting issues? Your customers can provide you with valuable insights.

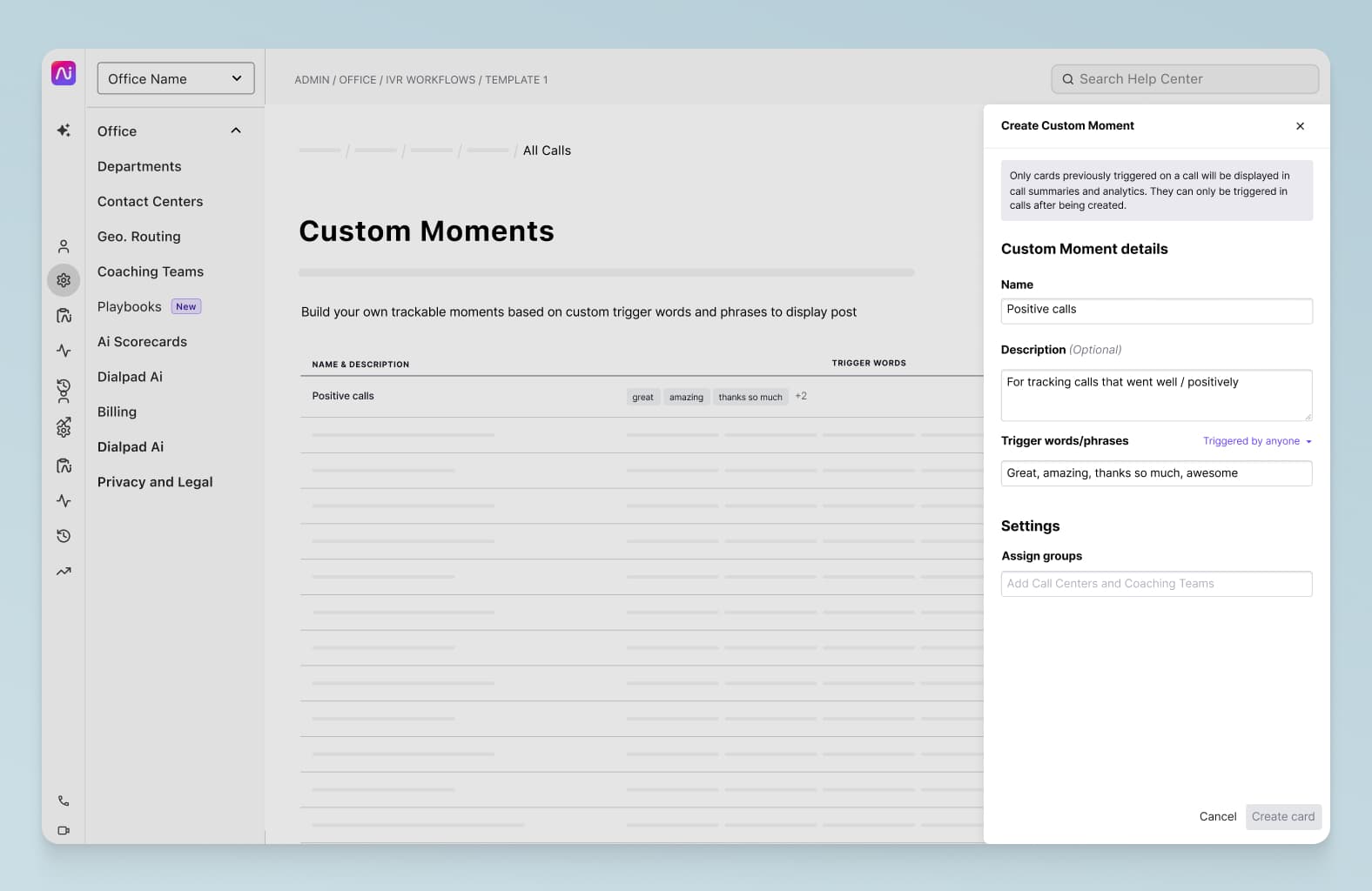

To calculate CSAT scores, you will usually ask consumers questions such as “How satisfied are you with your experience today?” and use a rating scale of 1 to 10, with 10 being “very satisfied” and 1 being “not satisfied at all.”

Once you gather all the relevant data, the formula is simple and straightforward:

So, what’s considered a good customer satisfaction score? It varies from industry to industry, so you should benchmark against your own industry and ideally other companies that are a similar size as yours.

One of the biggest challenges with using CSAT surveys—even though they are very effective and almost universally used across all industries—is the fact that very few customers tend to respond to them.

Most customers don’t bother responding to these surveys unless they’re very happy or very upset with a business, which can skew the results and give you an inaccurate view of how your overall customer base feels.

This is an area where solutions like Dialpad Support have unique Ai-powered features that can help. For example, Dialpad’s Ai CSAT feature can accurately predict the CSAT score of a customer conversation in real time—which means you can have data for up to 100% of your customer calls—without relying on customers to fill out surveys..

NPS surveys

Net Promoter Score, or NPS, surveys are the perfect tool to evaluate overall loyalty and how likely your customers are to promote your brand to their networks.

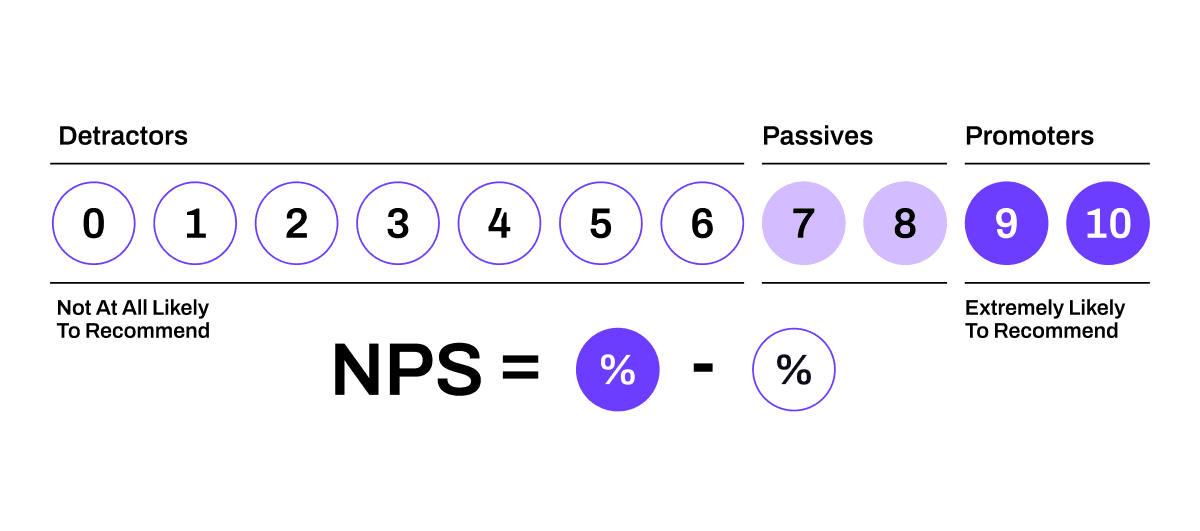

Typically, they include questions such as “On a scale from 0 to 10, how likely are you to recommend our products or services to a friend?” Or “how likely are you to recommend us to someone like you?”

The ensuing score—calculated by subtracting the percentage of detractors (ratings of 6 or lower) from the percentage of promoters (ratings of 9 or 10)—can be invaluable to guide your retention strategies:

A negative score—i.e., more detractors than promoters—could mean that your customer experience and retention initiatives are in dire need of a revamp. NPS is another popular type of customer survey, in large part because enthusiastic customers who are also brand advocates are a valuable source of positive word-of-mouth—and referrals,.

There is often confusion between CSAT and NPS surveys, as they both track the general happiness of customers with your brand. The key difference here is between “satisfaction” and “recommendation”. Just because someone is satisfied with your company, it doesn’t mean they’ll recommend you.

As NPS questionnaires focus on your brand in general rather than a specific interaction, they should not be sent to new customers—rather, they should be sent to customers who’ve had time to fully experience your product or service.

From there, you can share your questions again every four to 12 months to monitor shifts in customer sentiment and inform your retention strategies.

CES surveys

Customer Effort Score (CES) tracks how easy it is to use your products or services, find relevant information within your company, or resolve an issue with your support team.

Measuring CES involves asking customers to rate the difficulty of an interaction from “very difficult” to “very easy,” usually with a number between 1 and 5 or 7 (with a higher score representing a more effortless experience). If you want to be creative, emojis in the angry-to-happy range will also do.

You might ask questions like:

How easy was it to find the information you needed?

Was our customer support easy to contact?

Was our app easy to use?

You then divide the sum of responses by the total to find your score:

It goes without saying that the higher your CES, the better.

You might see similarities with NPS, and indeed understanding customer effort can help you estimate the likelihood of customer loyalty. When consumers have to work harder to get what they want, they’re less inclined to return for future services.

However, CES surveys can tell you so much more. As they're sent immediately after a brand interaction, you'll be easily able to spot gaps in your CX and user flows when scores are low. This way, you can address any obstacles or friction that are blocking your customers from a smooth experience.

Ultimately, CSAT, NPS, and CES surveys target different aspects of the customer journey—respectively, satisfaction, loyalty, and ease of use. You can use all three or any combination you like, depending on your goals.

Agent-specific surveys

The quality of customer support is often a key factor in driving loyalty and retention among consumers. Agent-specific surveys support this goal by allowing you to track and improve each individual team member’s effectiveness.

This survey type is sent immediately after an interaction with your customer service team and focuses on the performance of individual customer service representatives or sales agents.

You’d typically ask for feedback that aligns with KPIs, such as professionalism, knowledge, and overall helpfulness, as well as goals you want to measure against, such as speed and resolution rates.

By gathering these important customer service analytics, agent-specific surveys can provide an indicator of employee productivity over time and help managers identify specific training needs and reward top performers.

For example, companies such as Amazon and Slack frequently use these surveys to optimise their brand experience and avoid customer churn. By following their example, you can make your business shine above the competition.

Channel-specific surveys

Understanding how your customers prefer to communicate and which strategies are most effective to deliver important messages is another essential element of fine-tuning your CX initiatives.

With channel-specific surveys, you can target feedback from virtual assistants, email, phone support, social media, or even in-person interactions to assess the effectiveness of each communication channel.

In this context, common survey questions might include:

Was this your first time using the [name of channel]?

Would you use it again, based on today’s experience?

Were you able to reach your goal through this channel?

What other channels have you used in the past?

How could we improve your experience?

Once again, there are some similarities with other surveys, but to gain a complete view of an omnichannel consumer journey, you need a strategy that measures customer satisfaction for all types.

Of course, you also need to ensure enough customers are actually answering your surveys in the first place.

Top tips to get responses to your customer surveys

It’s clear that customer surveys can be a powerful tool for your business. However, as customers become increasingly busy, convincing them to participate is a bigger challenge than ever.

If you want to get enough data, it might be helpful to take a two-pronged approach: find ways to incentivise customers to respond to surveys, and also use Ai to supplement these explicit responses with conversation analysis.

We already mentioned examples of how to use Ai to glean more insights from your customer conversations. But what can you do to encourage more customers to respond to surveys? Here are a few best practices to maximise survey participation:

1. Use the right customer survey tools

Leveraging the right customer survey software is a must.

A modern platform can help you increase engagement, create a seamless survey experience, and simplify the survey analysis process. Look for tools that are intuitive to use for your agents and that integrate easily with your existing tech stack.

Take Dialpad Support, for example. All customer conversations from calls, messages, and external social channels are brought together on one collaboration platform.

Again, the Ai CSAT feature can analyse conversations to predict CSAT scores without needing customers’ survey answers:

This way, low response rates are no longer an issue.

2. Make your questions clear and specific

As with any other questionnaire or interview, the quality of answers is tightly linked to the quality of questions. After all, what good is a high response rate if the answers you receive are vague or irrelevant?

To craft an effective survey, first ensure your questions are easy to understand and impossible to misinterpret.

Keep it simple—especially if you are asking for a numerical rating—and remove all ambiguity. This will make your questionnaire easier to understand and complete, which improves response rates and accuracy.

Ask yourself whether your questions:

Contain confusing jargon or terminology

Elicit a negative emotional response

Are phrased in a way that biases the customer toward a certain answer. (e.g., “How much did you love our customer service?”)

3. Use open and closed (but not leading) questions

Depending on the type and goal of your survey, you might ask for numerical ratings. For instance “How satisfied are you on a scale from 1 to 5?” If you do, make sure your rating scales are consistent or you won’t be able to find reliable patterns in your customer data.

With questions that are more qualitative, you can use closed questions that elicit a simple yes or no response, such as “Are you happy with the quality of your product?”. But keep in mind that these don’t offer huge insights to help you make improvements.

You should also consider open-ended questions, such as “Who would you recommend this product to?”. This way, your customers will be able to provide important context for their opinions.

Just be sure to keep open questions short and simple, and avoid leading customers in one direction or another. After all, you want to know what they think—not what you wish they did.

4. Send your surveys at the right time via the right channels

When and how are essential, but often overlooked, factors when businesses send customer surveys.

In general, you should send questionnaires shortly after a customer interaction to capture feedback while the experience is still fresh in their minds. (This is why you’ll often see a message asking if you’d like to complete a survey immediately after a conversation with a live agent ends.)

It’s also important to consider whether the time of day is favourable to maximise survey responses (if you’re using a type of survey that doesn’t have to be sent immediately after a customer interaction).

To minimise friction, meet your consumers where they are. For instance, if they purchased something online, you could add a simple one-question survey to the order confirmation email or a pop-up box on your website. If they visit your store, you could try a QR code on product tags that leads to the survey. If you have an app, consider in-app pop-ups or forms.

5. A/B test your questions and surveys

All situations are unique, so the only way to find the perfect recipe is with a trial and error approach.

A/B testing different versions of the survey in advance roots out any issues or inconsistencies to improve response and completion rates.

This method usually involves sending the questions to a smaller group of trusted customers or company testers that can answer and provide feedback about the survey itself. Was it too long? Ambiguous? Did it load properly?

From there, you can analyse the responses to track anomalies in the distribution. This is the moment to catch poorly phrased questions that lead to forced answers.

The goal of this testing phase is to refine your survey so it offers a smooth experience for respondents and unbiased insights you can reliably act upon.

6. Show your gratitude to customers who take the time to answer

The way you respond after sending a survey influences how customers feel about taking valuable time out of their day to share their thoughts with you—and also how likely it is that they’ll answer additional questions next time you ask.

You should, at the very least, thank customers for the time they took to help you and for providing their insights. They should feel appreciated and valued if you wish to build a strong relationship and incentivise future participation.

Rewards such vouchers, discounts, or physical gifts are often used to encourage survey completion in the first place. (This strategy also creates a positive experience for consumers because it will make them a little more excited to provide answers—and more eager to receive similar propositions in the future.)

To differentiate your brand, don’t be afraid to get creative. For instance, some businesses use charity donations as an incentive for survey responses. Not only does this engage people who are driven by altruism, it also makes your company stand out for its values.

Last but not least, show your customers that their opinions matter and will drive actual change. The most powerful step of the customer feedback process is perhaps when customers see that their thoughts and feedback about your products or services are directly influencing your roadmap or service quality. By doing this, you won’t have to run ad campaigns or convince your customers that “you care about your customers”—they’ll already see that you do.

Get more valuable and actionable insights with an effective customer survey

Having a good customer survey strategy is essential for businesses seeking to improve their products, services, and overall customer experience.

The right questions can help you gain an objective view of your company’s strengths and weaknesses, from CX issues to individual team member performance.

But setting up a successful Voice of the Customer programme requires careful planning and execution. Consider:

Making use of automated and Ai-powered tools

Using a mix of CSAT, NPS, and CES surveys

Crafting clear, relevant, and engaging questions

Using the right channels for your customer base

Leveraging A/B testing

Showing gratitude to respondents to enhance the survey experience.

By using customer feedback to inform your service and product roadmaps, and refining your survey strategy over time, you can drive meaningful improvements, increase loyalty, and achieve long-term success in a competitive market.

Looking for a customer survey solution?

See how Dialpad Support’s Ai-powered CSAT feature works with a demo, or take a self-guided interactive tour of the app!