The ultimate customer churn guide, from a Customer Support leader

Customer Support Manager - Tier 1

Tags

Share

If you run any kind of subscription-based or SaaS company, tackling customer churn is probably something that consumes a lot of your time.

And while multiple teams, from Marketing to Sales, have a role to play in keeping customer churn low, the brunt of this work usually falls to Customer Support and/or Customer Success teams.

So, if you’ve noticed your monthly churn rate increasing or are just looking for ways to reduce churn, keep reading. I’ll walk you through what customer churn is, and share 10 strategies that in my experience as a Support Manager can help control churn, reduce lost revenue, and strengthen your customer relationships.

What is customer churn?

Customer churn, or customer attrition, is when customers stop using your products or services. Typically, this applies to companies with recurring-revenue business models—like SaaS companies and other subscription-based businesses.

A high churn rate can have a devastating effect on your overall revenue and bottom line, so you’ll want to keep this number low. It is possible to have negative churn, which is when your MRR (monthly recurring revenue) from your existing customers is more than the revenue you lost from customers leaving you or downgrading.

If you’re a retail business that sells clothing, you won’t really experience customer churn because those are one-off purchases and your customers won’t technically “churn out.”

👉 What’s involuntary churn?

Involuntary churn is a type of customer churn that isn’t your business’ fault. It might be a customer churning because of a credit card payment failure (e.g. an expired card or insufficient funds).

Now, let’s take a closer look at how to calculate the customer churn rate metric.

What is the customer churn rate?

Your customer churn rate tells you, as a percentage, how many of your customers have stopped doing business with you or downgraded their accounts. In other words, it’s the percentage of lost customers over a given period of time.

Note that even though customer churn is sometimes used interchangeably with revenue churn, technically the latter is looking specifically at lost revenue as opposed to lost customers.

Some degree of churn is normal, but if you notice churn increasing by an unusual amount, it could be a sign to examine your pricing, customer support, and/or customer lifecycle to try and understand what’s going on.

How to calculate customer churn rate

Calculating customer churn rate is relatively simple compared to some other customer engagement metrics. I’ll include the formula below, but before you start calculating, you’ll need to decide on a time frame to measure your customer churn over. That could be a month, a quarter, or a year. Next, you need to know how many customers you had at the start of the period you’re choosing to monitor and how many you were left with at the end.

The customer churn rate formula

Your churn rate is an expression of the number of customers lost as a percentage of your total original customer base. That means you’ll need to divide the number of customers lost by the total number of customers you had to start with, then multiply this by 100.

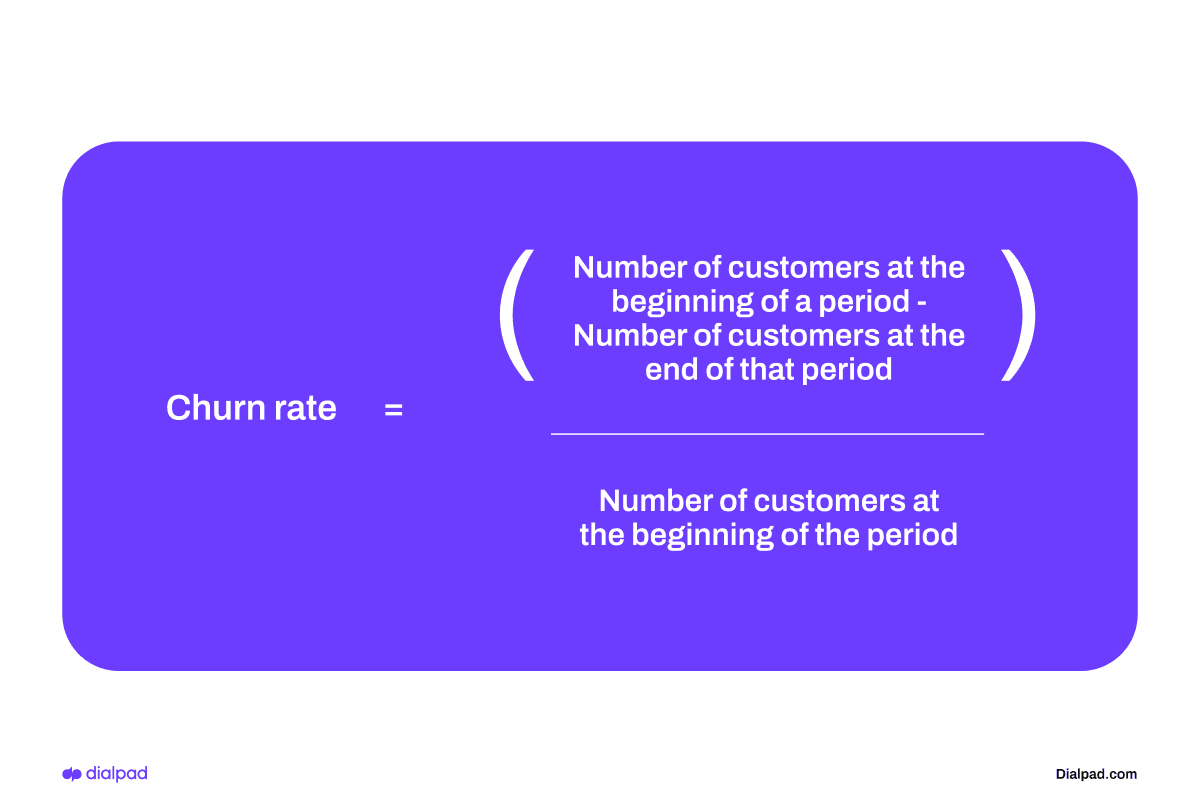

Here’s a graphic showing the churn calculation formula:

Here’s an example. Say I wanted to measure the level of customer churn in my business for the month of April. I started the month with 500 customers and, by the end of it, I lost 15 of them. I’d calculate the churn rate like this:

(15 ÷ 500) x 100 = 3

That would mean my business experienced a 3% churn rate that month.

Once you’ve done this over a certain period of time, you should start to notice trends, which will then help you with churn prediction in the future.

What is a customer churn analysis?

Once you’ve calculated your customer churn rate, you might want to do a more in-depth customer churn analysis.

A customer churn analysis is essentially a method of monitoring your customer churn rates and assessing the implications of these KPIs for your business. You want to figure out whether your customer churn rate is below average, about normal, or much too high, so you can act accordingly.

Conducting a customer churn analysis will help you identify key trends and avoid repeating common pitfalls that may have led to increased customer churn in the past. In other words, this is how you make improvements.

For best results, I’d recommend tracking churn rates over time and measuring them against other key performance indicators that impact profitability.

3 common customer churn mistakes to avoid

Being unable to identify your most influential customers

First things first, try to identify your most influential customers or product champions. In other words, the people who have the power to influence the purchasing decisions of others.

The loss of a product champion can be far more impactful than the loss of other types of account holders, so these are high-risk customers to lose. Monitor and actively nurture your relationships with your most influential points of contact at your customers’ organizations.

👉 Dialpad tip:

One related metric that’s quite popular is your NPS or Net Promoter Score, which measures how likely your customers will be promoters or detractors for your business.

Ignoring seasonal customer data

Another common mistake is for businesses to ignore seasonal data. People tend to assume customer churn rates will remain consistent over time and forget about external factors that might impact this, like seasonality.

The best way to account for fluctuations is to calculate a year-over-year churn rate. This will give you an idea of whether your rate has increased, decreased, or remained stable. For example, to calculate your year-over-year churn rate for January, you’d use the following formula:

So, if the churn rate in January 2022 was 4% and the churn rate in January 2021 was 2.5%, you’d calculate the year-over-year churn like so:

(4% - 2.5%)÷ 2.5% = 0.6%

This would mean your business experienced a year-on-year increase in customer churn of 0.6%.

Assuming all customers are equally valuable to the business

Remember what I said about focusing on your most influential customers? It’s time to flip that on its head and address another common mistake I encounter when working with businesses—the assumption that all customers are equally valuable.

In reality, this isn’t true, because each customer has different customer acquisition costs—and by extension, different customer lifetime values.

This is particularly relevant for businesses operating using a subscription model. Some customers will pay for premium pricing and features, while others might be using a free version of your service. Focusing on churn among non-fee paying customers won’t be representative of your MRR or overall revenue health.

How to reduce customer churn: 6 strategies

1. Identify the pool of customers that are most likely to cancel

One of the best ways to reduce churn is to anticipate it. Start by identifying people whose customer behavior suggests they’re likely to cancel their subscriptions, then narrow down your focus to those customers who are most valuable to you.

Re-engage these high-value customers who are at risk of churning—you can use phone calls or promotions, or get a Customer Success Manager to reach out to see how they can help optimize their customer experience.

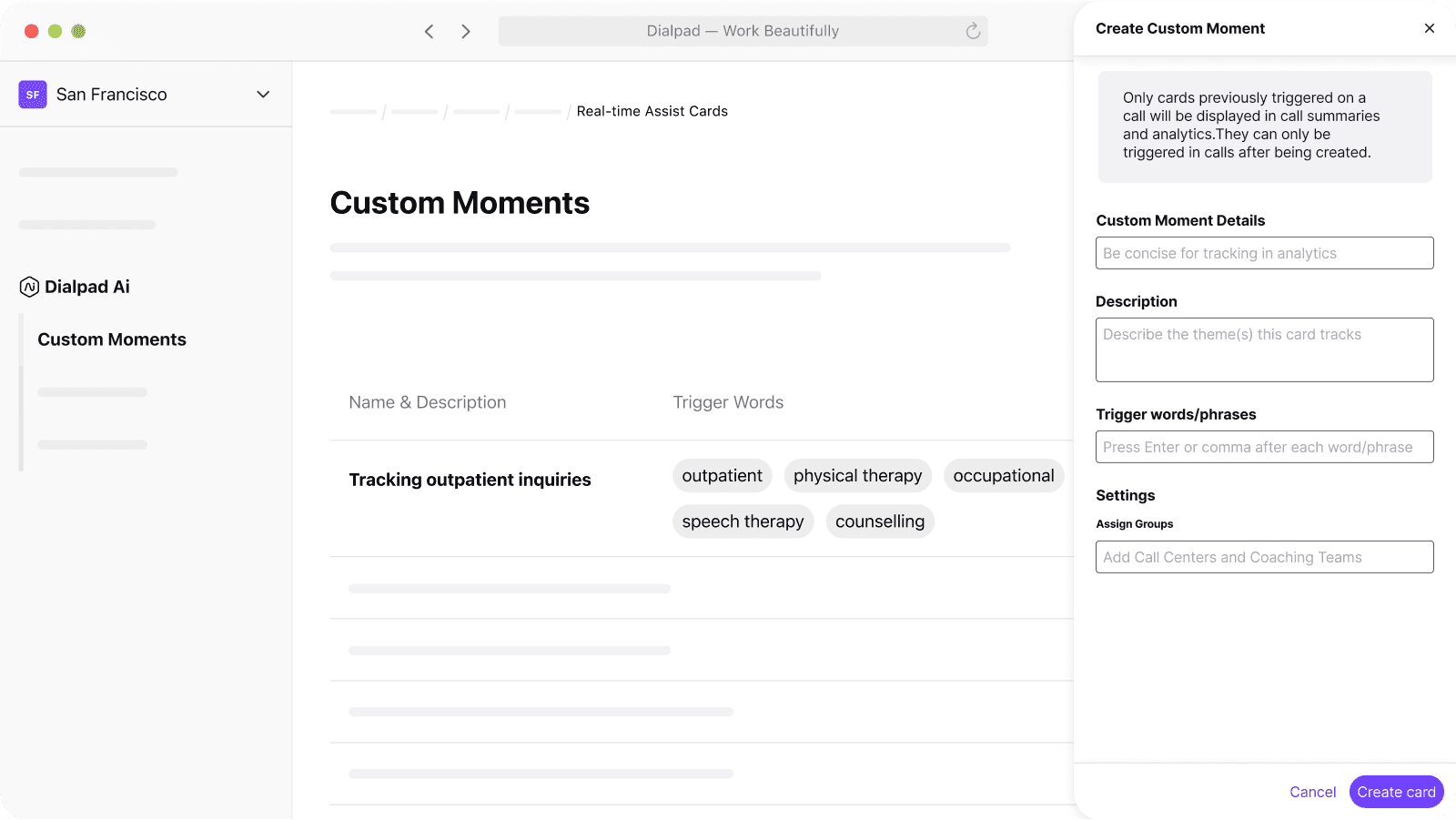

With Dialpad, for example, our Customer Support team could use the contact center functionality to track how often complaints or keyword terms like “money back” or “problem” come up on customer calls by creating “Custom Moments” to track those occurrences:

With this information, we can see if there are any trends or patterns between customers who complain. (Is it all related to a certain feature? Do those customers share any characteristics that are causing higher churn?) Using these customer experience analytics, you can dig into individual call recordings and transcripts to better understand why customers might be churning.

2. Invest in good customer engagement tools

Secondly, make sure you’ve got the right tools for the job. To prevent churn, it’s imperative to make sure your customers are not just content with your product, but also hitting any product usage milestones and staying engaged.

Having a good piece of contact center software is fundamental here, because it lets your Customer Support agents receive calls and also do outreach to current customers.

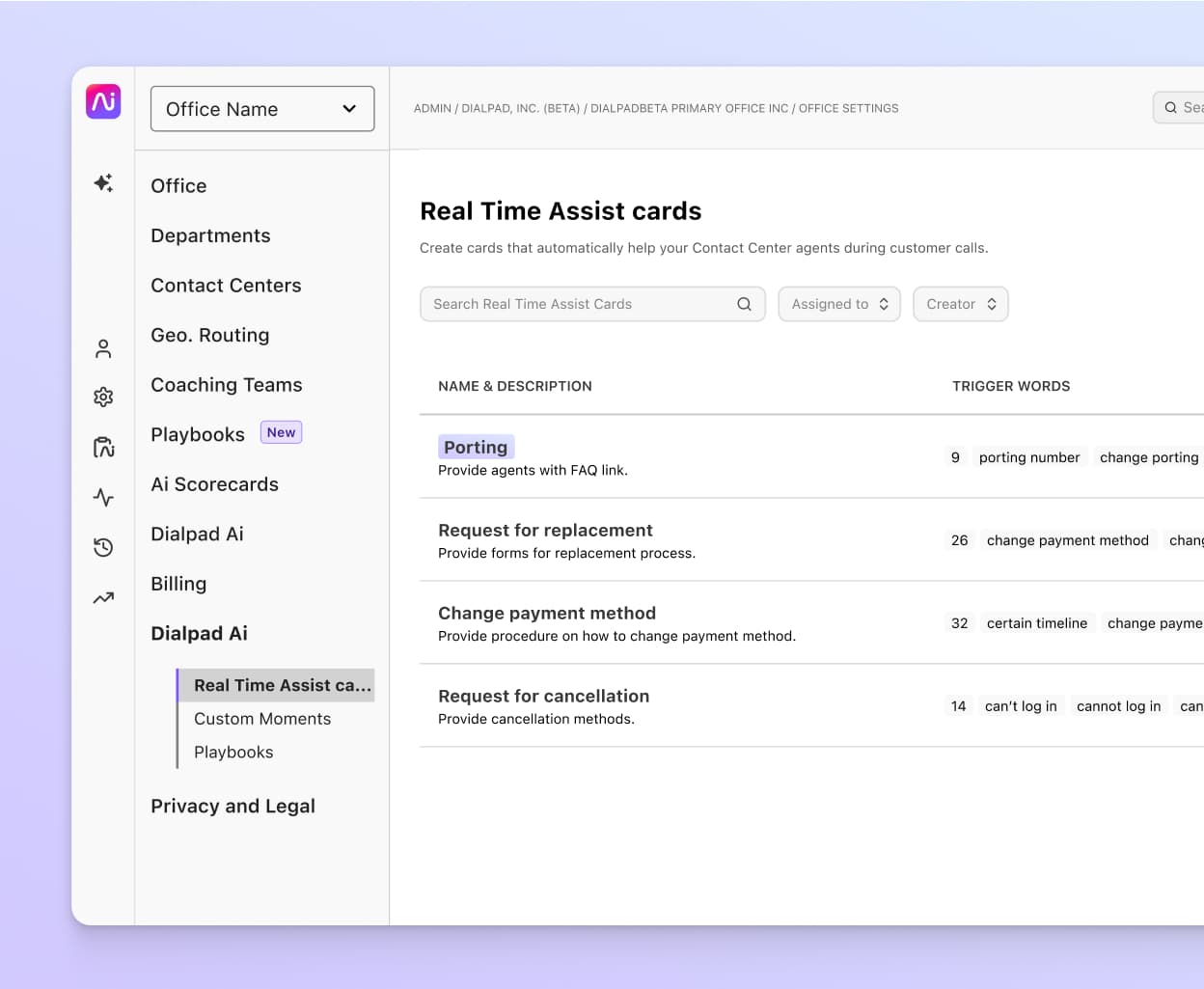

Dialpad Ai Contact Center goes one step further with its built-in AI functionality. For example, we can create RTA (Real-Time-Assist) cards that pop up automatically on agents’ screens when tricky topics come up on calls:

Dialpad also does real-time sentiment analysis, which lets supervisors quickly see when a call is going south so they can jump in to help a rep if needed:

Say we know that we’re getting lots of questions about how to add users to an account. We can create an RTA card with notes on how to walk a customer through that process and set it to pop up whenever “add users” or “add more people” is said on a call!

These are the kinds of automations that can really make life easier for not only your reps but also your supervisors, while improving productivity across the board.

3. Ask for feedback

Customer feedback is one of the most valuable types of insight you can get. And it usually doesn’t cost a lot to collect. To understand reasons for customer churn, why not go straight to the source?

Of course, this requires you to be able to record calls and have transcriptions of those conversations. It’s a lot more efficient and makes life easier for your support agents or Customer Success reps as opposed to having them manually take notes during their calls.

Some businesses might have sophisticated Voice of the Customer (VOC) programs, but you don’t necessarily need something super complicated to start gathering customer feedback.

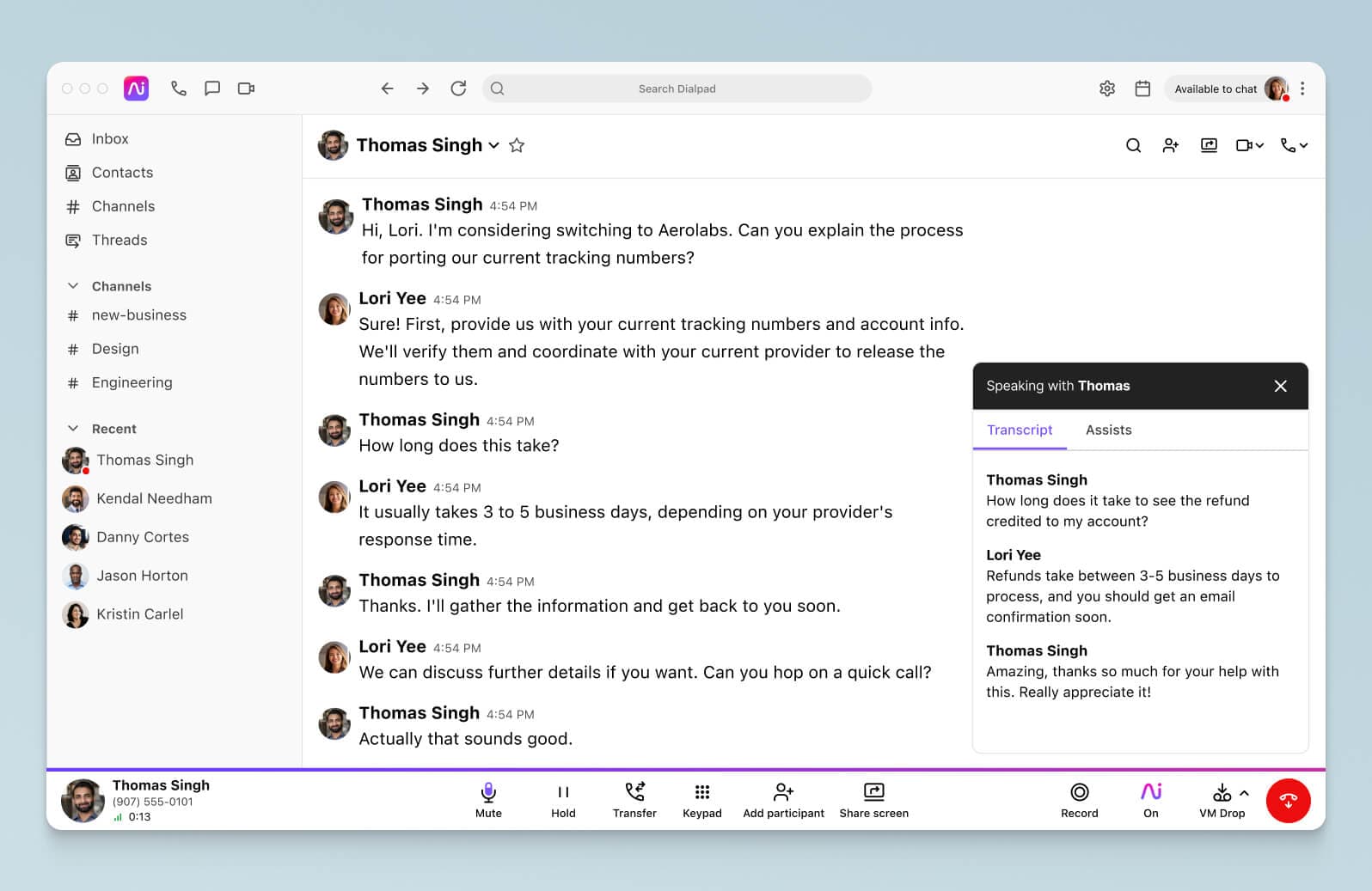

Our team, for example, uses Dialpad’s unified communications platform to have phone calls and video meetings with customers—and what’s great is that Dialpad Ai transcribes those conversations in real time (while helping us stay compliant!) for us:

We get automated meeting recap emails that include a searchable transcript and recording sent straight to our inboxes after every call, which is very helpful.

Another way to gather feedback is to run a CSAT survey to quantitatively measure how satisfied customers are after interactions with your business.

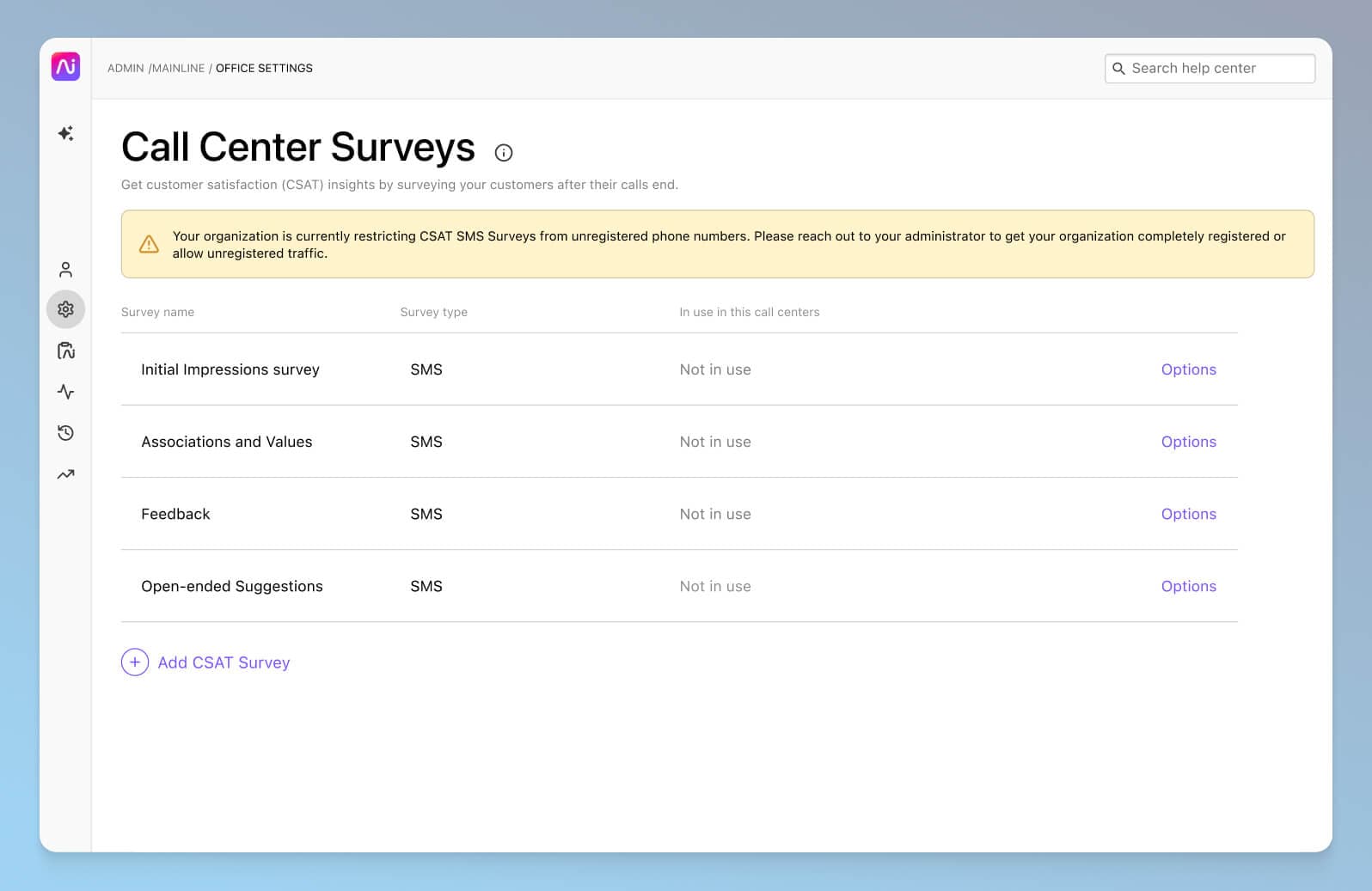

For example, Dialpad’s contact center platform has a built-in CSAT feature that lets you create your own customer feedback survey in just a few clicks:

One of the biggest challenges with CSAT surveys, though, is that not a lot of people actually fill them out.

In fact (depending on the industry and specific business of course), we've found that on average only about 5% of customers actually fill out CSAT surveys. On a related note, usually only the angriest—and happiest—customers actually bother responding, which means your CSAT scores are likely to be very skewed and not representative of how your customers feel overall.

To further increase survey participation, you can use QR code generator to create scannable codes for your feedback forms. Place these on receipts, packaging, or in-store displays, allowing customers to easily provide feedback.

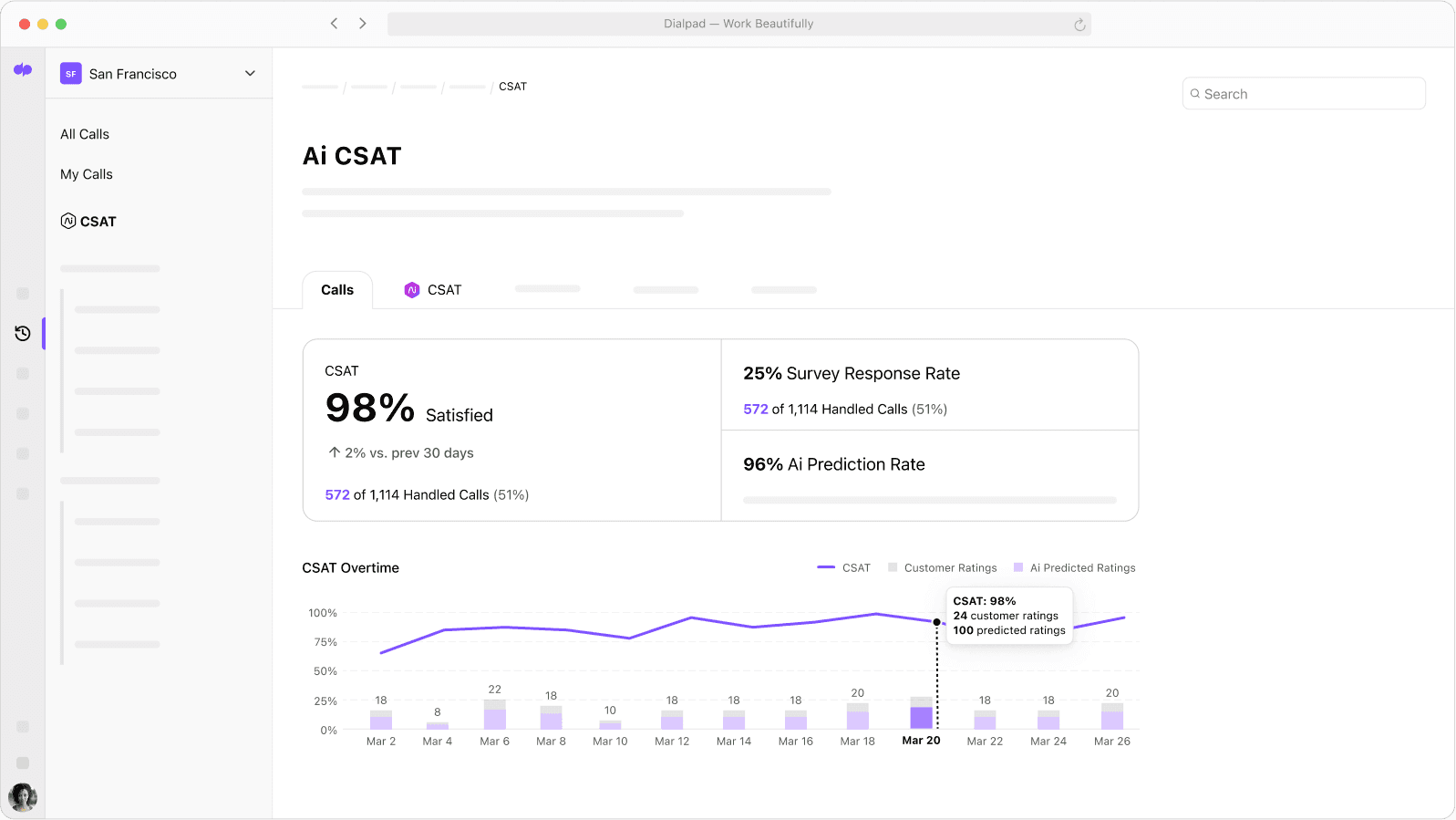

Dialpad's industry-first Ai CSAT feature is designed to solve exactly that. Not only can our Ai transcribe calls and analyze sentiment in real time, it can also infer CSAT scores for 100% of your customer calls thanks to its hyper-accurate transcription feature. The result? A much more representative sample size for CSAT scores, and a more accurate understanding of how satisfied your customers really are:

4. Empower your customer support team

Want to have loyal customers? Your customer support will play a big role in keeping customers happy and troubleshooting issues.

Being proactive is good, but it’s inevitable that customers will reach out at some point with questions. Your customer support agents have to be equipped to provide efficient omnichannel customer service if needed—through phone, live chat, social media, and so on.

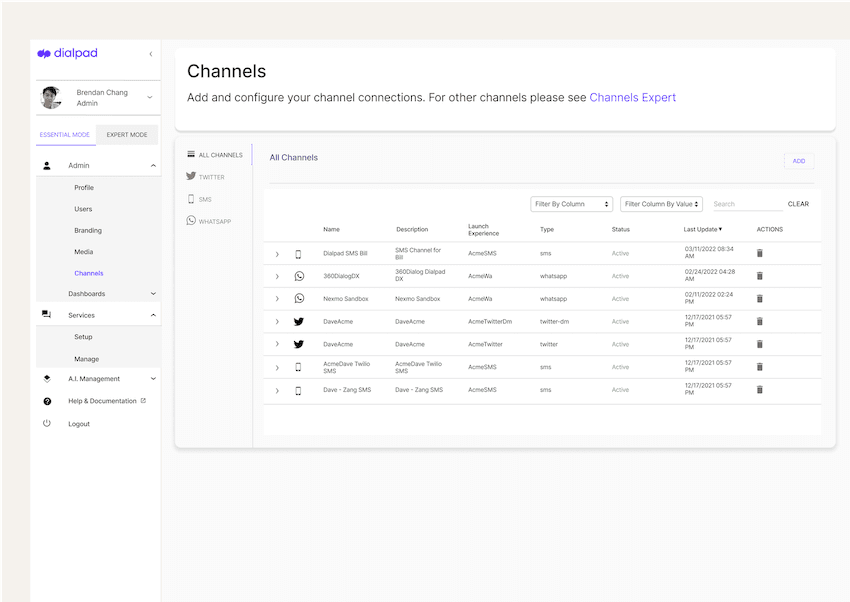

Dialpad’s contact center platform, for instance, is a great tool for this because it lets agents and reps handle all their customer communications in one place, from voice calls to live chat messages to digital and social media channels like WhatsApp and Facebook Messenger:

5. Be proactive by reaching out to customers before they need you

Another way to pre-empt churn and maintain customer retention rates is to reach out to customers before issues arise.

One way of providing customers with proactive support is to offer accessible self-service options as a fail-safe when your team isn’t available. For example, at Dialpad we have a detailed online Help Center—you could also have a support chatbot on your website that provides automated, 24/7 support.

From a customer success perspective, you could implement a well thought-out onboarding plan for new customers and use other customer journey management tactics that anticipate common questions and provide answers off the bat.

6. Offer incentives to customers

Sometimes, you just need a last-ditch tactic to save a valuable account. You may not even have done anything “bad”—your customer might’ve just disengaged or found another product or service that they want to try.

If you’ve exhausted all other avenues and you believe that there’s nothing else your team can humanly do to save a customer, you could try offering an incentive to give them a reason to stick around a bit longer.

Just remember that things like discounts, upgrades, or other customer loyalty tactics tend to be a Band-Aid solution—at some point, you’ll need to figure out the root cause of that customer wanting to leave and resolve that.

Ready to reduce customer churn?

From poor customer service for existing customers, to a bad onboarding experience for new customers, there are many reasons for customer churn.

If your team is looking for a good communications platform that lets you not only communicate with customers, but also get deeper insights into those conversations and track important metrics, why not see how our own team is using Dialpad Ai Contact Center to reduce customer churn?

Reduce churn with Dialpad's contact center platform

Get a personal walkthrough of the product or, take a self-guided interactive tour of the app!