A primer

Net promoter score (NPS)

How can you improve your NPS? What benchmarks should you be aware of? Keep reading to find out. Or, if you're looking for a contact centre platform that can help your agents improve the customer experience, book a product tour of Dialpad Ai Contact Centre!

First outlined by Fred Reichheld in the Harvard Business Review in 2003, the net promoter score (or net promoter system) has become one of the most popular ways to measure customer satisfaction.

Fun fact: Reichheld created NPS in collaboration with Satmetrix Systems and Bain & Company, Inc to formalise market research. Today, the net promoter score is an easy way to gauge your customer experience by using insights gathered directly from your customers themselves.

In this guide, we'll show you how to calculate your NPS, different ways to improve your NPS, NPS mistakes to avoid, and more. Skip ahead if you like.

What is a net promoter score?

NPS stands for “net promoter score" and is a very important customer experience metric. Specifically, it helps businesses understand the likelihood of a customer promoting their service or product to a friend or colleague.

The NPS index ranges from -100 to 100 depending on survey responses to the NPS question. The "NPS question" is often asked as part of a more general feedback exercise, and the one simple question that's central to all NPS surveys is some variation of “how likely on a scale from zero to 10 are you to recommend our brand/product/service?”

It's pretty straightforward to measure and use. When customers indicate on your NPS survey that they aren’t likely to recommend your product or service, it lowers your net promoter score. When they indicate they're likely to recommend you, your overall NPS increases.

One of the reasons so many businesses love using NPS is because it's a relatively objective and reliable way to predict business growth, customer loyalty, and retention.

👉 On "NPS scores"...

Just like saying "chai tea" (which basically means you're saying "tea tea"), saying "NPS score" also doesn't quite make sense because you're really saying "net promoter score score."

How to calculate your NPS

You actually don't need an NPS calculator to find out your NPS!

1. Get customer feedback through a survey

Surveys are probably the most common way to get feedback from customers. In fact, you could probably argue that the whole net promoter system depends on it.

NPS surveys can consist of just a single question: the NPS question. More often, though, this is asked alongside other questions related to the customer experience. (The exact questions asked in an NPS survey will vary from business to business, and many will only make sense within the context of a specific company.)

As you're planning your survey and methodology, keep in mind that different approaches may give you higher or lower response rates.

For example, you could do email surveys or social media questionnaires, and even get your frontline staff (like customer support agents) to ask your NPS question directly. Some customers are more likely to respond through SMS, while you may have better luck using email for others. This is something you'll want to test.

2. Sort respondents into categories based on their score

After responding to your NPS question, your survey respondents will fall into one of three categories.

Promoters

Because a higher score in response to the NPS question indicates respondents are more likely to recommend a product or service, customers who select nine or 10 are known as promoters.

Promoters are usually very satisfied with their experience of a brand and have had a positive experience during their customer journey. As well as being your best brand advocates, they’re the most likely to renew contracts or continue to use your product or service.

Passives

Passives are customers who selected seven or eight on your NPS survey. These customers tend to be satisfied with the product or service in question. But, they aren’t satisfied enough to promote it to others.

Your passive customers are more likely to be drawn to other competitors than promoters since they're satisfied, but not ecstatic about your product or service.

Detractors

Detractors are customers who select six or below on your NPS survey—and you guessed it, customers who aren't satisfied with your product or service and aren’t likely to recommend it to others. In fact, they're likely going to spread negative word-of-mouth.

As unsatisfied customers, NPS detractors are very susceptible to churn and unlikely to be repeat customers. Your options are limited, and clear: either improve your relationship with a detractor, or risk losing their business to a competitor.

3. Subtract detractor from promoter responses to get your net promoter score

Okay, onto your calculation. To calculate the NPS, you’ll need to subtract the percentage of detractors from the percentage of promoters. The percentage of passives isn’t featured in your calculation. This means:

Let’s say you survey 100 customers. If 10 respondents are detractors, 20 are passives, and 60 are promoters, your formula would look like this: 60 – 10 = 50.

The highest possible NPS is 100, indicating that 100% of survey respondents are promoters. The lowest possible score is -100. This would indicate all your survey respondents are detractors.

✨ UPLEVEL YOUR CONTACT CENTRE

Grab the Contact Centre Playbook, which breaks down everything you need to know, from setup to improving customer satisfaction—with examples from real contact centre teams across different industries.

The NPS mistakes to avoid making

Many businesses today now use NPS as a measure of customer satisfaction—but not all of them apply the methodology correctly, and not every company that collects NPS data is able to improve the customer experience and boost company growth.

Why is that?

Well, often it's because of five common mistakes.

Asking for customer feedback too soon

One of the most common pitfalls when you're asking for feedback?

Asking for it too soon.

You'd be surprised at how many businesses make the mistake of sending an NPS survey—immediately after the customer bought something.

If it's not clear why you shouldn't do this, there's one reason (just one, but it's enough) to wait before asking new customers about their experience. And it's this: most people won’t have any idea whether they like your product until they’ve at least tried it.

If you’re a retailer selling physical products, it’s best to wait until they’ve been delivered —and ideally, a while after that—before sending out your NPS survey.

(Unless of course, your survey is about the transaction experience, in which case your customer doesn't need to have used your product to give you their feedback. As long as they've gone through that transaction process, they'd be ready to tell you what they thought of it.)

The same goes for service providers—you should give your clients ample time to familiarise themselves with your services, and that time frame will likely vary depending on your specific service and customer base.

👉 Dialpad tip:

Transactional NPS surveys are typically sent out after a transaction, and ask customers how likely they’d be to recommend the business—based solely on that transaction experience. This is still a good metric to measure, as long as you're clear that these responses aren't about your product or any other aspect of your company. It's just about that transaction.

Burying NPS surveys in larger surveys

When conducting NPS surveys, it’s important to keep the primary objective clear. The ultimate question of your NPS survey should help you find out how likely your customers are to recommend you.

So, don't bury that NPS question! It'll lower your response rates. This isn't to say that you shouldn't get more detailed customer feedback, but if you want more people to respond to your survey requests, you'll have a better shot if you stick to three or fewer asks in your primary questionnaire—and maybe even highlight the one question that is a must-have. (Maybe your NPS?)

Not having a follow-up plan

It sounds harsh, but if you don't have a plan for how you're going to respond to your survey responses, then the whole process of doing an NPS survey ends up being an empty gesture.

Don't just have a bunch of prepared templates that aren't tailored to the different responses. At the very least, design separate responses for your promoters, neutrals, and detractors—you shouldn't be replying the same way to an unhappy customer as you do to a happy customer.

It sounds basic, but how many canned responses have you ever received from companies?

For detractors especially, the NPS follow-up is your opportunity to make up for whatever they feel let down by. With the right follow-up, you may even be able to turn detractors into promoters!

How do you implement an NPS survey? 5 steps

1. Choose your demographic questions

To effectively sort your NPS data, it can be helpful to establish some basic details about your customer.

One primary concern here is which product or service they’ve purchased from you. If you routinely send out NPS surveys after every sale, you should already have this information, so there’s no need to ask again.

If you send NPS surveys to your mailing list on a periodic basis and don’t already have a record of their transaction history, be sure to include this question.

2. Determine your net promoter score question

As we’ve already covered, the net promoter score question can be worded slightly differently according to your specific business or industry, but is always scored from zero to 10 based on the respondent’s likelihood of making a recommendation.

Again, the NPS question can be targeted toward the specific product or service the customer bought, their experience of being a customer, or their overall impression of the brand, among other options.

3. Ask the customer why they gave you the score

Knowing your NPS is fine, but having the context is even better. Use your NPS survey as a jumping-off point to collect more detailed customer feedback.

If you can, make the space and time for customers to leave as much or as little additional feedback as they like.

4. Ask customers how you can improve their experience

If asking respondents why they gave the NPS score they did can highlight what they liked or didn’t like about their customer experience, then asking how the experience could be improved prods people toward offering the constructive criticism you need to instigate change.

This is super valuable, yet underrated, insight to have. Not everyone will give you a great answer that you can use, but you need to at least create an opportunity to gather these insights.

5. Ask permission to follow up with the customer

Before following up on NPS responses, it’s best to ask the customers’ permission and let them know how the follow-up will take place. This can be an additional question at the end of the survey or a box that respondents can tick (where they agree to be contacted in the future).

This is an important step that not only closes the loop, but also tells the customer that you're serious about implementing their feedback. Don't forget this step!

✒️ Vetting different contact centre solutions?

This RFP checklist covers the essentials to be aware of and why they may be important for your contact centre.

Why is NPS data so valuable?

It helps you determine how loyal your customers are

As well as telling you a respondent is likely to recommend your company to a peer, a score of nine or 10 suggests they’re happy enough with their experience to want to repeat it. With this information, you can better predict business growth, decide whether it's better to invest your dollars into customer experience or training, and more.

It makes it easier to identify areas where you can improve

Although every company wants to minimise its quantity of NPS detractors, customers who respond to the NPS question with a low score are the ones you should be paying the most attention to.

NPS detractors will help you identify areas where your customer experience isn’t meeting their standards. Use this information to move forward and create a better experience in the future.

It can help you build a referral marketing program

Referral marketing refers to a marketing strategy that relies on word-of-mouth to generate positive publicity for your brand.

And because your NPS question is based on someone’s likelihood of making a recommendation, a high NPS may already reflect organic brand advocacy. It can also be used to target NPS promoters for involvement with referral initiatives, knowing in advance they’d already happily recommend your company.

It helps you fix things with unhappy customers (before they blast you publicly)

As well as identifying happy customers to target for referral marketing campaigns, calculating NPS can help you find the unhappy customers you should be reaching out to.

Often, there's a very good reason why a customer left a low score in your NPS survey, and if you can get them to talk to you, it'll help you nip problem areas in the bud early. Don't forget to offer them a gift or something for their time. For example, if their issue was that they thought the product they bought was overpriced, offer them a discount on their next purchase.

Getting in touch with NPS detractors before they have a chance to leave a negative review online or tell their friends they had a bad experience can prevent the kind of negative publicity that hurts your brand.

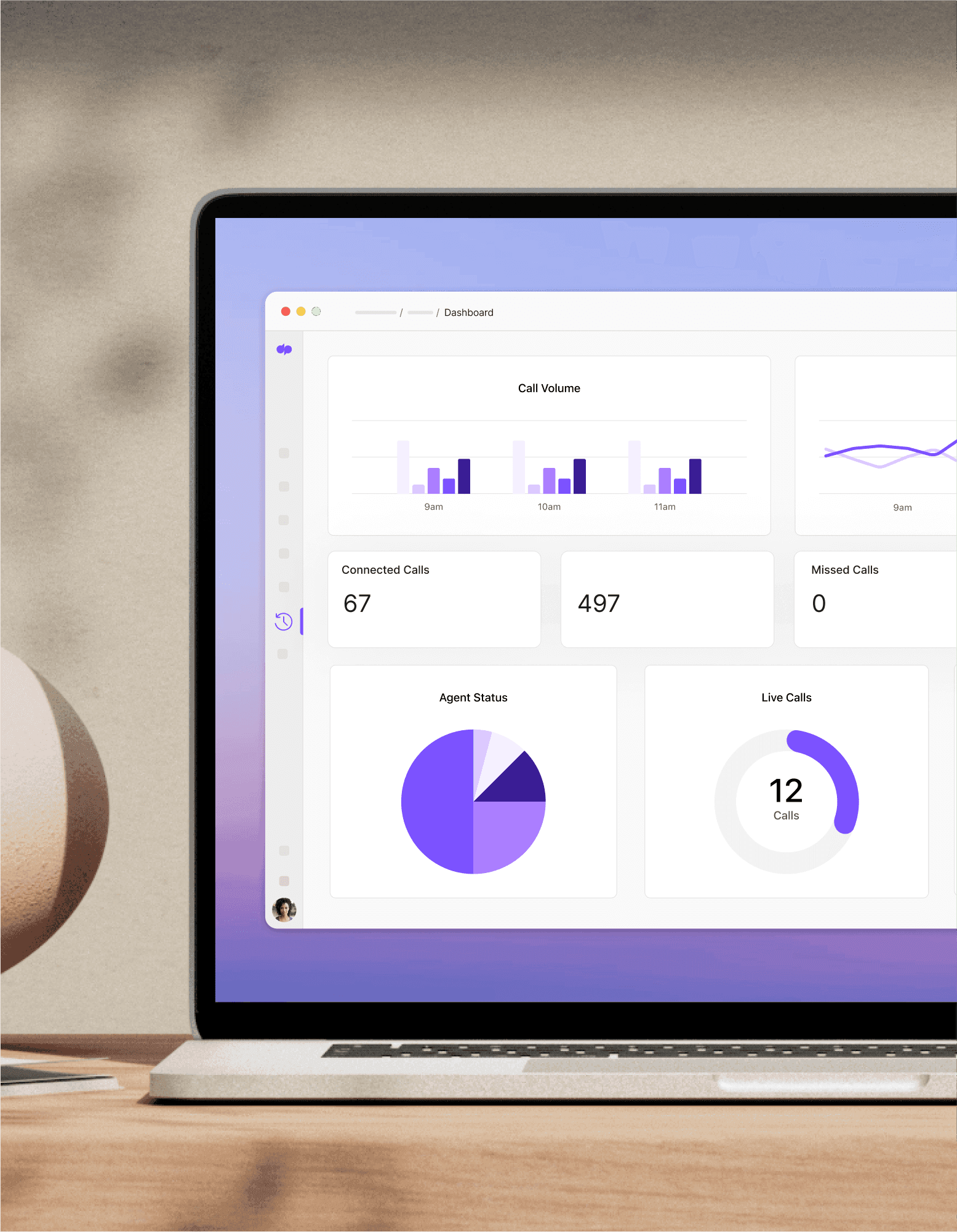

Need better tools to help you improve your NPS?

Dialpad's contact centre platform is intuitive and easy-to-use, and is designed to help customer support teams provide a better experience over the phone and through other channels. Book a walkthrough to see how it can work for your agents and supervisors, or take a self-guided interactive tour of the app on your own!