How Financial Express improves collaboration with Dialpad Ai

When Terry McGinnis set out to launch Financial Express, Britain's first decentralized finance exchange, he wasn't just aiming for innovation—he was paving the way for a financial revolution. "Our mission," Terry explains, "is to redefine finance with security and compliance at its core. We're not just a company—we're a movement towards a better tomorrow."

Financial Express is the principal operator of LVP (Live Value Protection Protocol) which provides an exchange, blockchain technology for individuals, private companies, government departments, and agencies who want to utilize the latest in decentralized finance, blockchain technology, artificial intelligence, machine learning and other derivatives. In the world of decentralized finance, this is a big deal—it helps make decentralized finance more open, secure, and accessible to users.

In addition, Financial Express is also one of the first decentralized finance companies that has physical gold as an insurance policy. If you’re wondering what this does, if the market is down, the company can stabilize the exchange’s security token (also known as cryptocurrency LVP), which would mean they won’t need government bailouts or public funding. This gives users a big boost in confidence about using the exchange.

The journey, however, was not without its challenges. The company's rapid expansion and global reach strained their existing communication system. "We needed tools that could keep up with our pace. Tools that could erase borders and time zones," Terry says, recalling the limitations of their previous communications systems. The quest for a scalable, efficient communication platform was paramount.

“We needed digital collaboration tools to help us scale”

Although many communications platforms approached Financial Express, the Dialpad for Startups program gave them the opportunity to test the platform. As a new company, this was a big deal. “We did not want to commit to anything yet, but Dialpad gave us time to test the platform and functionalities,” says Terry.

After hearing about Dialpad through a referral, they were impressed with the entire experience, from discovery to onboarding. “Dialpad provided us with personal touchpoints. There were no automated chats or huge wait times to solve issues. The experience was very human, which is rare these days,” says Terry.

Dialpad also stood out thanks to its scalability and uptime. “We needed digital collaboration tools to help us scale, rather than physical phone systems. We didn’t want to have to rent lines as it’s not scalable for our team, which is mostly made up of remote, global workers,” says Terry. With teams scattered across the globe, Dialpad's promise of seamless digital collaboration resonated with them.

The onboarding process also sealed the deal for the team. “The onboarding process was extremely easy. We didn’t need any new physical devices when setting everything up. We also didn’t need an engineer to set anything up. Everything is done on the cloud,” says Terry.

A unified communications platform for more efficient collaboration

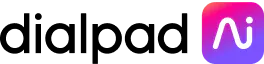

With Dialpad, the team experienced a communication metamorphosis. This seamless integration means that transitioning from a call to a video conference is just a click away—a small change with profound impacts on productivity and client engagement. "It's remarkable how integrating voice calls and meetings into one platform can drive such efficiency," Terry notes. Since everything is on a single platform, the team does not need to spend time switching between devices or windows either.

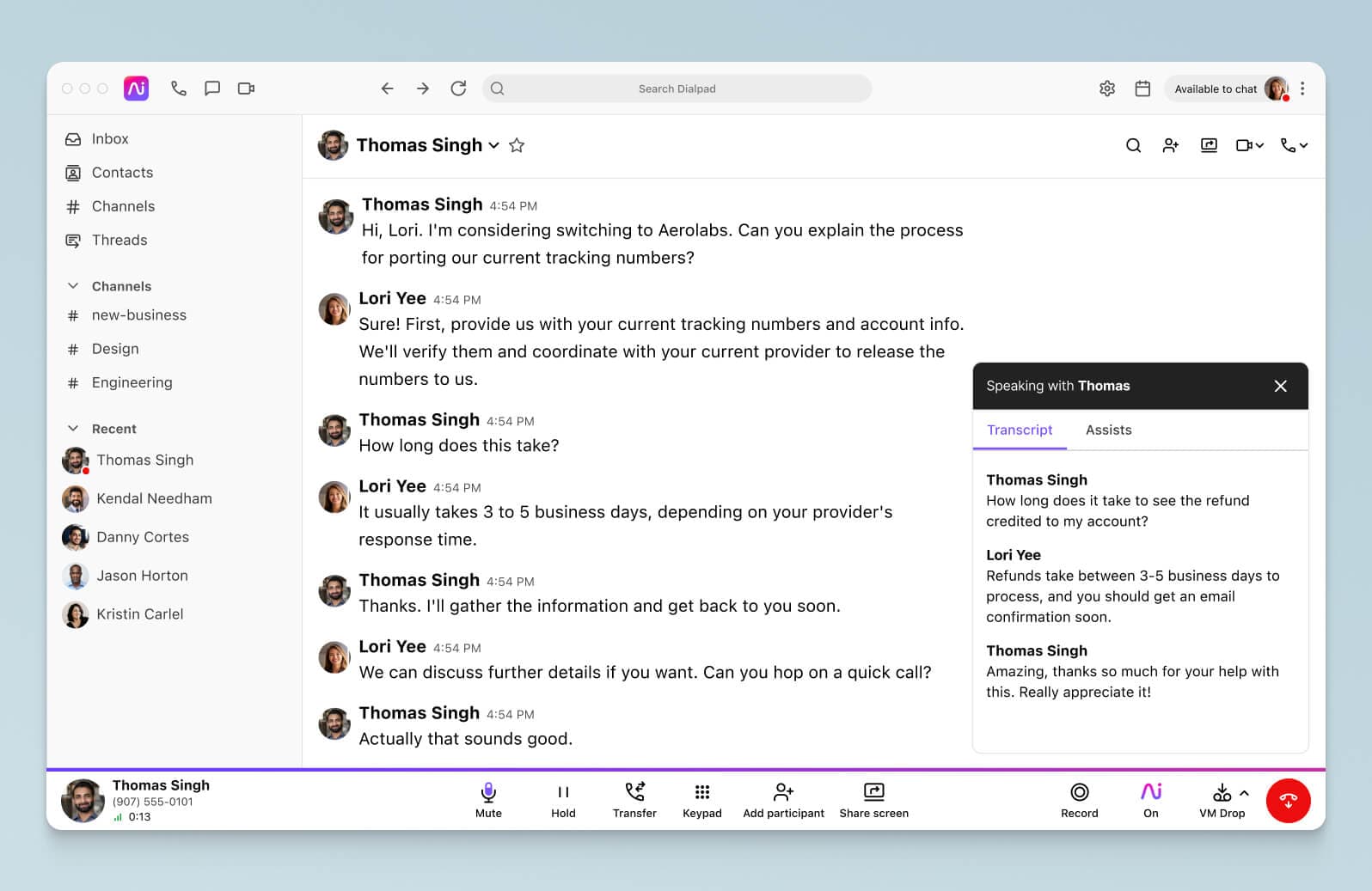

Dialpad's Ai Transcriptions are also a game-changer for Terry's team, and help them provide a better experience during calls. Their conversations are now more focused on human connection during calls. “We can easily create post-meeting minutes and don’t have to rely on typing quickly during calls,” says Terry. This feature, combined with Dialpad's internal chat, are fostering a new level of efficiency in collaborations. Teams could now share information swiftly, ensuring everyone was on the same page, a crucial factor in their fast-paced industry.

A platform that can grow as the company scales

The financial benefits of switching to Dialpad were significant. “We’re saving £6,000 per month when we compare Dialpad to our previous providers,” says Terry. But for Terry, the value extends beyond just cost savings. "It's about investing in a system that not only understands our current needs but anticipates our future growth," he reflects. “With the cost savings, we can use the funds to create an even better product for our customers.” Dialpad's ease of use and scalability have been instrumental in streamlining their operations, setting them up for continued expansion and innovation.

We can’t wait to see how Financial Express continues to use more Dialpad features to help their team grow and provide a better customer experience!

Ready to serve your customers better?

Learn how Dialpad’s AI-powered solutions are helping finance companies save money and serve their customers better. Book a demo, or take a self-guided interactive tour of the app first!